Information

Contributes 3 million ounces of production, enhancing grades and extending mine livesAll projects have an attractive NPV and IRR at a range of gold prices (This news release contains forward-looking information about

Original sourceAI Summary

Kinross announced three growth projects in January 2026. Projects will add 3 million gold ounces production, extending mine life significantly. The total capital expenditure for these projects is around $425 million in 2026. Strong projected IRR of 55% and NPV of $4.1 billion at $4,300 gold price. Transitioning to underground mining is expected to enhance cost efficiency.

Sentiment Rationale

The announcement of growth projects adds significant gold production and enhances financial metrics, likely boosting investor confidence and stock price, similar to past announcements that resulted in price increases.

Trading Thesis

The projects will begin contributing to production from 2028 and are expected to improve cost structures, indicating a sustained positive impact over several years.

Market-Moving

- Kinross announced three growth projects in January 2026.

- Projects will add 3 million gold ounces production, extending mine life significantly.

- The total capital expenditure for these projects is around $425 million in 2026.

Key Facts

- Kinross announced three growth projects in January 2026.

- Projects will add 3 million gold ounces production, extending mine life significantly.

- The total capital expenditure for these projects is around $425 million in 2026.

- Strong projected IRR of 55% and NPV of $4.1 billion at $4,300 gold price.

- Transitioning to underground mining is expected to enhance cost efficiency.

Companies Mentioned

- GOLD (GOLD)

- NEM (NEM)

- AUY (AUY)

Corporate Developments

The detailed exploration and expectations for future production directly relate to KGC's financial performance and operational outlook, significantly influencing stock prices.

Contributes 3 million ounces of production, enhancing grades and extending mine lives

All projects have an attractive NPV and IRR at a range of gold prices

(This news release contains forward-looking information about expected future events and performance of the Company. We refer to the risks and assumptions set out in our Cautionary Statement on Forward-Looking Information located on page 16 of this release. All dollar amounts are expressed in U.S. dollars, unless otherwise noted.)

TORONTO, Jan. 15, 2026 (GLOBE NEWSWIRE) -- Kinross Gold Corporation (TSX:K, NYSE:KGC) ("Kinross" or the "Company") today announced that it is proceeding with the construction of three organic growth projects: the Round Mountain Phase X and Bald Mountain Redbird 2 projects in Nevada, and the Kettle River-Curlew ("Curlew") project in Washington. These projects are expected to meaningfully extend mine life and will benefit long-term costs within Kinross' United States (U.S.) portfolio.

Overall highlights1:

- Continued positive exploration results and robust internal studies have demonstrated strong margins with average all-in sustaining costs2 (AISC) of ~$1,650 per gold equivalent ounce ("Au eq. oz.") at an attractive Internal Rate of Return3 (IRR) and Net Present Value4 (NPV) that supports proceeding to construction.

- These projects are expected to contribute significantly to Kinross' U.S. production profile and to maintaining 2 million Au eq. oz. per year, with expected production of 400,000 Au eq. oz. per year between 2029 and 2031 and a total of 3 million Au eq. oz. between 2028 and 2038, based on the initial mine plan inventories.

- Strong value proposition with a combined IRR of 55% and a combined incremental post-tax NPV4 of $4.1 billion at a gold price of $4,300.

- All three assets have significant potential for mine life extensions beyond the initial mine plan inventories included in the completed project studies, potentially further enhancing returns and asset values.

- Phase X and Curlew continue Kinross' grade enhancement strategy, adding higher grade underground ounces and benefitting long-term costs at lower capital intensity as well as providing optionality for further mine life extension beyond the initial mine plan inventories. Redbird 2 provides a substantial mine life extension of efficient open pit mining at Bald Mountain with incremental AISC2 of $1,466 per Au eq. oz.

- Kinross intends to self-fund these projects from its operating cash flows and has forecasted capital expenditures of approximately $425 million in 2026 to support their development. Total attributable capital expenditures5 for the global portfolio in 2026 are expected to be $1.5 billion (+/- 5%).

- As at December 31, 2025, the Company had completed its 2025 share repurchase program, achieving its increased target of $600 million in shares and reducing its share count by 2.5%. The Company will continue to prioritize its strong balance sheet, liquidity and return of capital program.

Round Mountain Phase X highlights1:

- Robust Economics: Post-tax NPV4 of $1.9 billion and IRR3 of 67% at a gold price of $4,300 per ounce.

- Extended Mine Life: The project adds 1.4 million Au eq. oz. to the life-of-mine production at Round Mountain, with expected average incremental production of approximately 140,0006 Au eq. oz. per year, and extends mine life by eight years to 2038.

- Cost Profile: In line with the Company's thesis of transitioning to higher grade bulk tonnage underground mining, the incremental Phase X life-of-mine AISC2 of $1,680 per Au eq. oz. and production cost of sales per Au eq. oz. sold7 of $1,576 are expected to lower the cost profile at Round Mountain.

- Initial Underground Reserve and Resource: Initial underground reserve of 1.2 Moz. Au eq. at 3.2 g/t, plus further indicated underground resource of 0.2 million Moz. Au eq. and inferred resource of 0.5 Moz. Au eq.

- Further Upside: Significant potential for both proximal growth and extension of the resource down dip demonstrated by existing intercepts outside of the initial reserve and resource.

Curlew highlights1:

- Robust Economics: Post-tax NPV4 of $1.2 billion and IRR3 of 44% at a gold price of $4,300 per ounce.

- Leveraging Existing Infrastructure: Restarting Kinross' Kettle River mill to process high-grade mineralization from the Curlew underground deposit ~40 kilometres ("km") northwest of the mill.

- Near Term Producer: ~100,000 gold ounces ("Au oz.") expected per year for the first five full years, with an initial 11-year mine life at an average mine grade of 5.8 g/t. First production expected in 2028 and life-of-mine production of approximately 940,000 Au oz.

- Cost Profile: Life-of-mine AISC2 of $1,726 per Au oz. and production cost of sales per Au oz. sold7 of $1,487.

- High-Grade Expansion Potential: Potential for further extension of wide, high-grade mineralization at both Stealth and Roadrunner based on existing intercepts provides further project upside.

Bald Mountain Redbird 2 highlights1:

- Robust Economics: Post-tax NPV4 of $1.0 billion and IRR3 of 58% at a gold price of $4,300 per ounce.

- Extended Mine Life: Redbird 2 and five satellite deposits add a combined 643,000 Au oz. of production, with approximately 155,000 Au oz. expected per year, extending mine life to early 2032.

- Cost Profile: High-productivity, low-cost mining leading to an incremental life-of-mine AISC2 of $1,466 per Au oz. and production cost of sales per Au oz. sold7 of $1,360.

- Resource and Exploration Upside: Significant potential for further mine life extension at Bald Mountain both from exploration and from the current resource – highlighted by the Top open-pit deposit. The 2025 resource contains 2.5 Moz. Au measured and indicated plus 0.8 Moz. Au inferred.

CEO commentary

J. Paul Rollinson, CEO, made the following comments in relation to the projects' announcement:

"We are excited to be moving ahead with Round Mountain Phase X, Curlew and Bald Mountain Redbird 2. These three new growth projects are expected to contribute 3 million ounces of life-of-mine production to our portfolio, extend mine lives at our Nevada assets well into the 2030s, and benefit our long-term costs in the U.S. Together they deliver attractive economics with an expected quick payback, an IRR3 of 55% and a cumulative NPV4 exceeding $4.1 billion at a $4,300 gold price.

"Higher-grade underground mining at Phase X and Curlew reflect the next phase of our grade enhancement strategy that we initiated in 2022. The transition to underground mining at Round Mountain is anticipated to initially extend mine life to 2038 and deliver incremental annual production of approximately 140,0006 gold equivalent ounces. Curlew is a high-grade restart opportunity in Washington, leveraging our existing Kettle River mill infrastructure, with an initial 11-year mine life at an average mining grade of 5.8 g/t. Drilling at both assets has already shown wide, high-grade intercepts outside of the initial resource that demonstrate the upside potential for further resource and mine life additions, which will continue to be a focus of our exploration.

"Redbird 2 is expected to deliver high-productivity, low-cost production as the next anchor pit alongside five satellite pits. They are designed to add approximately 155,000 gold ounces of annual production, initially extending Bald Mountain's mine life to 2032, with further upside potential within the extensive land package.

"By funding these projects with cash flow from our operations, we are reinvesting in our business to generate additional value in internal projects underpinned by a low-cost structure and excellent economics. As we look forward, these new projects are well timed and are expected to start contributing in 2028, coinciding with getting back to higher-grade mining at Tasiast. We look forward to unlocking their full potential as we continue delivering value for our shareholders, communities and employees."

Round Mountain Phase X overview

The Phase X project is a bulk tonnage underground mining opportunity below the current Phase W open pit at Round Mountain, targeting higher-grade, lower-cost mining of the same mineralization at depth as part of the Company's grade optimization strategy to offset inflation and increase future margins at the site.

Phase X underground will benefit from the strong existing infrastructure at site and will be processed through the existing mill in parallel with remaining open pit mineralization and stockpiles.

The Company expects Phase X to incrementally produce approximately 1.4 million Au eq. oz. over an initial 11-year mine life, starting in 2028, extending production at Round Mountain until 2038, and averaging approximately 140,000 Au eq. oz. per year from 2029 to 2037. Phase X is expected to lower Round Mountain's future costs with an incremental AISC2 of $1,680 per Au eq. oz. sold.

| Round Mountain Phase X incremental physical highlights1 | |

| Average underground annual production (koz. Au eq./yr) (2029-2037) | 140 |

| Life-of-mine production (koz. Au eq.) | 1.4 million |

| Peak mining rate (tpd) | 4,800 |

| Average grade processed (g/t Au) | 3.0 |

| Average recovery rate (% Au eq.) | 88 |

| Round Mountain Phase X financial highlights1, 2, 3, 4, 7, 8 | ||||||

| $3,200/Au oz. | $4,300 /Au oz. | |||||

| Average production cost of sales (per Au eq. oz. sold) | $1,485 | $1,576 | ||||

| Average all-in sustaining costs (per Au eq. oz.) | $1,590 | $1,680 | ||||

| Total initial capital expenditures (millions) | $400 | $400 | ||||

| IRR | 40% | 67% | ||||

| NPV(5%) | $1,044 | $1,881 | ||||

| Payback (years) | 3.0 | 1.9 | ||||

Mine and processing plan

The Phase X project is planned as a bulk tonnage underground operation, with first production expected in 2028, ramping up to a peak mining rate of 4,800 tonnes per day (tpd). Mining costs and AISC are expected to benefit from the wide, consistent nature of the deposit, with an average width of 120 metres. The primary mining method is transverse long-hole open stoping with paste backfill following a bottom-up mining sequence.

The mining cost and efficiency will also benefit from three underground accesses, including two declines that are already in place and a third decline planned for 2028 to enhance both ventilation and haulage routes. The mine plan includes an investment in early development of infrastructure for both the upper and lower zones to allow mining of both zones concurrently, increasing the production rate and overall efficiency of mining.

The underground mineralization from Phase X will be processed through the existing 10,000 tpd milling facility at Round Mountain, blending the higher-grade underground mineralization with lower grade open pit production from Phase S and with low grade stockpile from historic open pit mining thereafter.

The Phase X mine plan inventory has the same geometallurgy as what has been mined historically at Round Mountain, and is expected to have an average recovery of 88% based on a robust metallurgical testwork program, extensive history of processing this mineralization and a bulk sample of the underground deposit in 2025 that demonstrated positive grade reconciliation.

Capital expenditures and permitting

The initial project capital costs are expected to be approximately $400 million to be spent over four years, primarily related to underground development, procurement of mining equipment, and construction of underground infrastructure. The study results indicated that the capital for the transition to underground is significantly lower per ounce compared with expected capital expenditures for further extensions of the open pit.

The infrastructure has been designed to support a long-life, highly productive underground mine with increased investment to drive higher production rates and economies of scale, including optimization such as the development of both the upper and lower zones concurrently and the addition of a third portal.

The initial capital also includes use of a mining contractor for the majority of the capital development in 2026, 2027, and 2028, which is intended to de-risk the critical path to first production in 2028 and provides a two-year timeframe to ramp up internal labour resources for self-perform underground mining.

Development of the underground headings and infrastructure is already well underway, benefiting from the six km of underground development and dual declines completed as part of the exploration program.

The project's execution timeline is significantly de-risked with federal permits for underground mining at 3,000 tons per day already secured; Kinross expects to receive a minor federal modification to increase the mining rate beyond 3,000 tons per day and finalize the state mining authorization for Phase X in Q1 2026, marking the completion of all major operational permitting.

| Forecast Round Mountain Phase X project initial capital costs | ($ millions) |

| Underground development & mining equipment | 240 |

| Underground infrastructure | 90 |

| Indirect & contingency | 70 |

| Total | 400 |

Initial Phase X underground reserve and resource

The study and mine plan for Phase X are based on a significant initial underground reserve and resource at Round Mountain that has been defined on the back of nearly 35 km of infill drilling since 2023.

| Round Mountain Phase X Summary of project mineral reserves and resources9 (As of December 31, 2025) | |||

| Classification | Tonnes | Grade | Gold Eq. Ounces |

| (000) | (g/t Au) | (000) | |

| Probable Reserves | 11,042 | 3.2 | 1,150 |

| Indicated Resources | 2,198 | 2.6 | 182 |

| Inferred Resources | 6,024 | 2.4 | 458 |

As the Phase X underground mine plan inventory overlaps with historic open pit resources from Phase W at Round Mountain, the conversion to underground mining results in a reduction in the lower-grade, open-pit resource at Phase W and a net reduction in the resource base at Round Mountain.

Transitioning to underground mining at Round Mountain is expected to increase the operation's grade profile and results in superior economics compared with continued open pit operations at Phase W, including lower costs, higher margins, significantly higher IRR and NPV, and increased long-term optionality for mine-life extensions.

Exploration upside potential

This initial underground reserve and resource is a point in time estimate and only demonstrates a portion of the long-term potential of the asset. There is significant potential to extend the reserve and resource at Phase X through both proximal and down dip exploration, with existing intercepts already showing mineralization with similar width and grade outside of the Phase X underground reserve and resource.

These potential future extensions are expected to come with lower incremental capital costs compared with further open pit extensions at Phase W, leveraging the $400 million initial Phase X capital expenditures. The primary additional capital for further reserve and resource additions is expected to be incremental development of ramps and access levels to exploit the potential resource extensions.

Resource extensions down dip also have the potential to increase the underground mining rate at Phase X by opening more stoping zones, resulting in a higher mill grade and production than the initial mine plan assumes.

Curlew overview

The Curlew project is a high grade, underground gold mine located ~40 km northwest of the Company's 100%-owned Kettle River mill and tailings facilities. Kinross has a long history of production in the region and significant infrastructure in place. The Kettle River mill has produced 2.8 million Au oz. historically and it was moved to care and maintenance in 2017.

The Company expects Curlew to produce approximately 940,000 Au oz. over an initial 11 year mine life from 2028 to 2038, averaging approximately 100,000 Au oz. per year for the first five full years, and 85,000 Au oz. per year for the life-of-mine.

| Kettle River-Curlew physical highlights1 | |

| Underground annual production (koz. Au/yr) - first 5 full years10 | 99 |

| Underground annual production (koz. Au/yr) - life-of-mine | 85 |

| Life-of-mine production (koz. Au) | 938 |

| Mill processing rate capacity (tpd) | 1,800 |

| Average mining rate (tpd) | 1,518 |

| Average grade processed (g/t Au) | 5.8 |

| Average recovery rate (% Au) | 80 |

| Kettle River-Curlew financial highlights1, 2, 3, 4, 7, 8 | ||||||

| $3,200/Au oz. | $4,300/Au oz. | |||||

| Average production cost of sales (per Au oz. sold) | $1,445 | $1,487 | ||||

| Average all-in sustaining costs over life-of-mine (per Au oz.) | $1,684 | $1,726 | ||||

| Total initial capital expenditures (millions) | $485 | $485 | ||||

| IRR | 24% | 44% | ||||

| NPV (5%) | $528 million | $1.2billion | ||||

| Payback (years) | 3.2 | 2.0 | ||||

Mine plan

Curlew is planned as a high grade underground operation, with first production expected in 2028, ramping up to a peak mining rate of 1,800 tpd. AISC benefits from the strong average grade of 5.8 g/t and good mining widths with an average width of over six metres for the first five years and four metres life-of-mine. The mining methods will include both longitudinal and transverse long hole open stoping with cemented and uncemented rockfill following a bottom-up mining sequence.

The project leverages the existing portal and underground infrastructure from the historic K2 mine, which will be extended to support mining of the current Curlew deposit.

The mine plan will target the widest, highest-grade mineralization first driving the higher expected average gold production of approximately 100,000 Au oz. per annum for the first five full years.

Existing drilling outside of the current resource shows potential to expand with higher-grade, wider mineralization, which would be prioritized ahead of the lowest-grade mineralization in the current mine plan inventory, and providing potential to maintain the 100,000 Au oz. per year production rate for longer.

Mill, processing, and tailings design

Mineralization from the Curlew mine is planned to be processed through the existing 1,800 tpd Kettle River mill. The mill includes conventional crushing, grinding, and carbon-in-leach (CIL) gold recovery, and will be refurbished as part of the restart project.

A new tailings dewatering plant will also be installed at the existing tailings management facility to convert from conventional to dry stack tailings.

Capital expenditures and permitting

The initial project capital costs for the Curlew project are expected to be approximately $485 million to be spent over three years, primarily related to underground development, procurement of mining equipment, refurbishment of the mill, and the addition of the tailings dewatering plant.

The initial capital for the Kettle River mill restart is focused on supporting reliable long-term operations through a fulsome refurbishment given the long initial mine life, the age of the mill, and the potential for further mine life expansion beyond 2038.

Learnings from previous mill restart projects, such as La Coipa, have been incorporated into our estimates and additional capital has been added through recent study phases to replace processing equipment including crushers, mills, pumps, cyclones, and feeders.

The initial capital also includes additional costs for the use of a mining contractor for the initial capital development to de-risk the critical path to first production and provide more time to ramp up internal resources.

| Forecast Kettle River-Curlew project initial capital costs | ($ millions) |

| Underground development & mining equipment | 215 |

| Mill refurbishment & surface infrastructure | 145 |

| Indirect & contingency | 125 |

| Total | 485 |

The site construction program is well advanced and critical early works are complete. The Company is on track to award major contracts for mining and construction in early 2026, and is advancing the hiring of key roles for project execution and operations.

All significant permits for mining and processing activities have been received with the exception of one state-level permit related to the tailings height increase, which is expected to be received in 2026.

Exploration upside potential

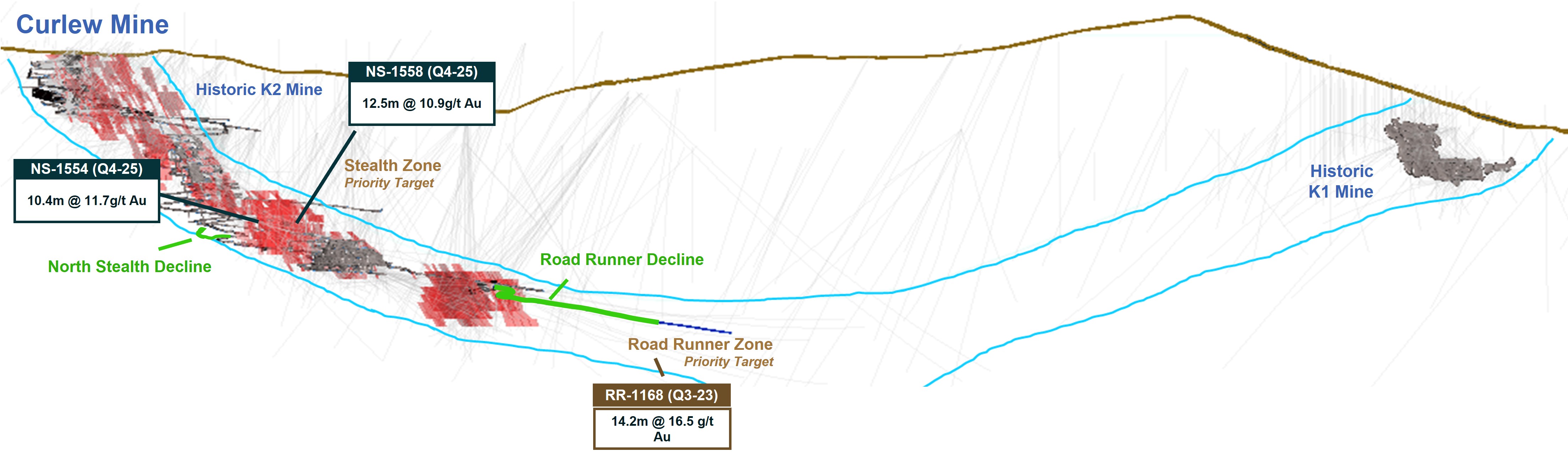

Kinross' Curlew project offers significant upside potential, driven by ongoing exploration success and the geological prospectivity of the district. Drilling campaigns have consistently grown the resource at depth, with more recent intercepts confirming higher grades and improved mineability in the lower zones. The Company is focused on targeting wider, higher-grade extensions along the productive paleosurface which includes multiple historic mines, including K1 and K2, to both extend the overall resource and enhance the production profile from 2034 onward.

Drilling programs are already underway in areas such as Stealth North and Roadrunner, and wide, high-grade intercepts outside of the current resource have already shown potential for further resource expansion.

Figure 1: Curlew exploration upside

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/8b2af52c-faaf-43da-8125-0c73e969fc14

Bald Mountain Redbird 2 overview

The Redbird 2 project consists of Phase 2 of the Redbird pit along with five additional satellite pits that combined are expected to incrementally produce a total of approximately 640,000 Au oz., with first production in 2028 and an average production of approximately 155,000 oz. Au per year between 2028-2031, extending production at Bald Mountain until early 2032. The project leverages the existing infrastructure, equipment, and workforce at Bald Mountain, continuing the long history of successful open pit heap leach operations on the extensive land package.

The approval of Redbird 2 builds on the Q4 2024 decision to proceed with mining of Phase 1 at Redbird and the associated conversion of approximately one million resource ounces to reserves. In 2025, an additional 0.2 Moz. Au have been included from Redbird 2 and the new satellite deposits, more than offsetting depletion to grow the total reserves.

| Bald Mountain Redbird 2 incremental physical highlights1 | |

| Annual production (koz. Au/yr) (2028-2031) | 155 |

| Life-of-mine production (koz. Au) | 643 |

| Peak mining rate (ktpd) | 229 |

| Average grade processed (g/t Au) | 0.5 |

| Average recovery rate (% Au) | 66 |

| Bald Mountain Redbird 2 financial highlights 1, 2, 3, 4, 7, 8 | ||||||

| $3,200/Au oz. | $4,300/Au oz. | |||||

| Average production cost of sales (per Au oz. sold) | $1,300 | $1,360 | ||||

| Average all-in sustaining costs (per Au oz.) | $1,406 | $1,466 | ||||

| Total initial capital expenditures (millions) | $490 | $490 | ||||

| IRR | 32% | 58% | ||||

| NPV(5%) | $484 million | $1.0 billion | ||||

| Payback (years) | 2.4 | 1.7 | ||||

Mine plan and processing

The mine plan centres on laybacks of previously mined pits, with Redbird 2 planned to be the next anchor pit and five satellite pits – Poker, Casino, Bida, Galaxy and Saga – complimenting Redbird's output and improving the production profile.

The strategy of mining both an anchor pit at Redbird and concurrent satellite pits is aligned with the historic mining strategy at Bald Mountain, and provides significant economies of scale to support high-margin production at the operation.

The location of the Redbird pit, close to the existing Bald Mountain heap leach, truck shop, and administrative facilities, also drives efficient operations and lower costs for the project with an expected incremental AISC2 of $1,466/oz.

Processing of Redbird 2 will take place on the Bald Mountain heap leach pad, and processing for the satellite pits will take place on the Mooney heap leach pad. The heap leach pads will be expanded to accommodate the additional mine plan inventory from this project.

Capital expenditures and permitting

The initial project capital costs for the Bald Mountain Redbird 2 project are expected to be $490 million to be spent over three years, primarily related to waste stripping for the open pit mines, expansion of leach pads to accommodate the additional mine plan inventory, and process infrastructure enhancements including the installation of a Sulphidization, Acidification, Recycling and Thickening (SART) plant.

Initial capital was increased through the Redbird 2 study phase with the addition of the SART plant, addition of the satellite pits, and additions to the mining fleet. The SART plant will add flexibility to process higher copper mineralization, lowering operating costs, increasing life-of-mine production, and de-risking recovery. The addition of the satellite pits and additional mining fleet is expected to improve the annual production profile by providing more concurrent mining and increasing the economies of scale at the site.

| Forecast Bald Mountain Redbird 2 project initial capital costs | ($ millions) |

| Mining & equipment | 325 |

| Initial infrastructure | 125 |

| Indirect & contingency | 40 |

| Total | 490 |

Permitting for Redbird is well advanced, with the Redbird pit, three of the five satellite pits, and the two heap leach facilities fully permitted, allowing for the start of project ramp-up this year.

Exploration and upside potential

Bald Mountain's large, prolific land package, demonstrated by the more than 40 historic pits on the property, continues to be a focus for further exploration to extend mine life. Exploration in 2024 and 2025 was successful in both growing and defining the satellite pit inventories to complement the Redbird 2 mining profile. Going forward, exploration will continue to focus on both satellite pit additions and discovering new anchor pits at the operation.

Bald Mountain has a substantial 2.5 Moz. Au measured and indicated resource, and 0.8 Moz. Au inferred resource. This includes the next expected anchor pit, the Top pit, which is already in the existing resource with more than 1 Moz. contained. The Top pit is already permitted for mining and will be the next focus of project study at Bald Mountain for further life-of-mine extensions beyond 2032.

Self-funded capital expenditures

Kinross intends to fund the three projects from operating cash flows and will maintain its disciplined approach to managing its business, including continuing to strengthen its balance sheet and return capital to shareholders.

In 2025, Kinross repaid $700 million of debt, returned over $750 million to shareholders through its increased dividend and share buyback plan, and ended the year with approximately $1 billion in net cash11. Further, the Company had available credit12 of $1.6 billion as of September 30, 2025, and no debt maturities prior to 2033 following the early repayment of the 2027 senior notes in Q4 2025.

Capital expenditures guidance

The following section of the news release represents forward-looking information and users are cautioned that actual results may vary. We refer to the risks and assumptions contained in the Cautionary Statement on Forward-Looking Information on page 16 of this news release.

This guidance section references attributable capital expenditures, which is a non-GAAP financial measure, as applicable, with no standardized meaning under IFRS and therefore, may not be comparable to similar measures presented by other issuers. The definition of this non-GAAP financial measure is included on page 11 of this news release.

To support the development of these three organic growth projects, Kinross has forecasted capital expenditures of approximately $425 million in 2026. Total Kinross attributable capital expenditures5 for 2026 are forecast to be approximately $1.5 billion (+/- 5%).

Technical presentation details

In connection with this news release, Kinross will hold a virtual technical presentation and audio webcast at 9:00 a.m. EST on Thursday, January 15, 2026, followed by a question and answer session.

Technical presentation details:

Webcast link: https://meetings.lumiconnect.com/400-874-048-179

Canada & US toll-free – +1 (800) 990-2777; Conference ID: 78159

Outside of Canada & US – +1 (416) 855-9085; Conference ID: 78159

Replay (available 30 days after the call):

Webcast Replay link: https://meetings.lumiconnect.com/400-874-048-179

Canada & US toll-free: 1-888-660-6264

Outside of Canada & US: 289-819-1325

Passcode: 78159 #

You may also access the presentation on a listen-only basis via webcast at www.kinross.com. The audio webcast will also be archived at www.kinross.com.

About Kinross Gold Corporation

Kinross is a Canadian-based global senior gold mining company with operations and projects in the United States, Brazil, Mauritania, Chile and Canada. Our focus is on delivering value based on the core principles of responsible mining, operational excellence, disciplined growth, and balance sheet strength. Kinross maintains listings on the Toronto Stock Exchange (symbol: K) and the New York Stock Exchange (symbol: KGC).

Media Contact

Samantha Sheffield

Director, Corporate Communications

phone: 416-365-3034

Samantha.Sheffield@Kinross.com

Investor Relations Contact

David Shaver

Senior Vice-President, Investor Relations & Communications

phone: 416-365-2854

InvestorRelations@Kinross.com

APPENDIX A

Non-GAAP financial measures and ratios

The Company has included certain non-GAAP financial measures and ratios in this document. These financial measures and ratios are not defined under IFRS and should not be considered in isolation. The Company believes that these financial measures and ratios, together with financial measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. The inclusion of these financial measures and ratios is meant to provide additional information and should not be used as a substitute for performance measures prepared in accordance with IFRS. These financial measures and ratios are not necessarily standard and therefore may not be comparable to other issuers.

For more information, please refer to the Company's most recently filed Management's Discussion and Analysis for a reconciliation of the attributable all-in sustaining cost and attributable capital expenditures figures to the related GAAP figures.

All-in sustaining cost (AISC) per equivalent ounce sold

All-in sustaining cost per equivalent ounce sold is a non-GAAP financial ratio calculated based on guidance published by the World Gold Council ("WGC"). The WGC is a market development organization for the gold industry and is an association whose membership comprises leading gold mining companies including Kinross. Although the WGC is not a mining industry regulatory organization, it worked closely with its member companies to develop this metric. Adoption of the all-in sustaining cost metric is voluntary and not necessarily standard, and therefore, this ratio presented by the Company may not be comparable to similar ratios presented by other issuers. The Company believes that the all-in sustaining cost ratio complements existing measures and ratios reported by Kinross.

All-in sustaining cost includes both operating and capital costs required to sustain gold production on an ongoing basis. Sustaining operating costs represent expenditures expected to be incurred that are considered necessary to maintain production. Sustaining capital represents expected capital expenditures comprising mine development costs, including capitalized waste, and ongoing replacement of mine equipment and other capital facilities, and does not include expected capital expenditures for major growth projects or enhancement capital for significant infrastructure improvements.

Attributable capital expenditures

Attributable capital expenditures are either sustaining capital expenditures or non-sustaining capital expenditures, depending on the nature of the expenditure. Sustaining capital expenditures typically represent capital expenditures at existing operations including capitalized exploration costs and capitalized development unless related to major projects, ongoing replacement of mine equipment and other capital facilities and other capital expenditures and is calculated as total additions to property, plant and equipment, less non-sustaining capital expenditures. Non-sustaining capital expenditures represent capital expenditures for major projects, including major capital development projects at existing operations that are expected to materially benefit the operation, as well as enhancement capital for significant infrastructure improvements at existing operations. Management believes the distinction between sustaining capital expenditures and non-sustaining expenditures is a useful indicator of the purpose of capital expenditures and this distinction is an input into the calculation of attributable all-in sustaining costs per gold equivalent ounce. The categorization of sustaining capital expenditures and non-sustaining capital expenditures is consistent with the definitions under the WGC all-in cost standard.

Attributable capital expenditures includes Kinross' 70% share of capital expenditures for Manh Choh. Management believes this to be a useful indicator of Kinross' cash resources utilized for capital expenditures.

Appendix B

Subset of 2025 Annual Mineral Reserve and Resource Statement

| Proven and Probable Mineral Reserves | ||||||||||||||||

| MINERAL RESERVE AND MINERAL RESOURCE STATEMENT | GOLD | |||||||||||||||

| PROVEN AND PROBABLE MINERAL RESERVES (1,2,3,4,5,6,7) | ||||||||||||||||

| Kinross Gold Corporation's Share at December 31, 2025 | ||||||||||||||||

| Kinross | Proven | Probable | Proven and Probable | |||||||||||||

| Location | Interest | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | ||||||

| (%) | (kt) | (g/t) | (koz) | (kt) | (g/t) | (koz) | (kt) | (g/t) | (koz) | |||||||

| NORTH AMERICA | ||||||||||||||||

| Bald Mountain | USA | 100% | 0 | 0.0 | 0 | 66,306 | 0.6 | 1,225 | 66,306 | 0.6 | 1,225 | |||||

| Round Mountain | 7 | USA | 100% | 5,365 | 0.3 | 59 | 39,690 | 1.4 | 1,829 | 45,055 | 1.3 | 1,888 | ||||

| Measured and Indicated Mineral Resources | ||||||||||||||||

| MINERAL RESERVE AND MINERAL RESOURCE STATEMENT | GOLD | |||||||||||||||

| MEASURED AND INDICATED MINERAL RESOURCES (2,3,4,5,6,7,8,9,10,11) | ||||||||||||||||

| Kinross Gold Corporation's Share at December 31, 2025 | ||||||||||||||||

| Kinross | Measured | Indicated | Measured and Indicated | |||||||||||||

| Location | Interest | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | ||||||

| (%) | (kt) | (g/t) | (koz) | (kt) | (g/t) | (koz) | (kt) | (g/t) | (koz) | |||||||

| Bald Mountain | USA | 100% | 5,678 | 1.0 | 188 | 139,266 | 0.5 | 2,360 | 144,944 | 0.5 | 2,548 | |||||

| Curlew Basin | 11 | USA | 100% | 0 | 0.0 | 0 | 1,993 | 6.4 | 409 | 1,993 | 6.4 | 409 | ||||

| Round Mountain | 7 | USA | 100% | 0 | 0.0 | 0 | 81,275 | 0.6 | 1,446 | 81,275 | 0.6 | 1,446 | ||||

| Inferred Mineral Resources | ||||||||||||||||

| MINERAL RESERVE AND MINERAL RESOURCE STATEMENT | GOLD | |||||||||||||||

| INFERRED MINERAL RESOURCES (2,3,4,5,6,7,8,9,10,11) | ||||||||||||||||

| Kinross Gold Corporation's Share at December 31, 2025 | ||||||||||||||||

| Kinross | Inferred | |||||||||||||||

| Location | Interest | Tonnes | Grade | Ounces | ||||||||||||

| (%) | (kt) | (g/t) | (koz) | |||||||||||||

| Bald Mountain | USA | 100% | 78,862 | 0.3 | 790 | |||||||||||

| Curlew Basin | 11 | USA | 100% | 4,151 | 6.3 | 838 | ||||||||||

| Round Mountain | 7 | USA | 100% | 61,269 | 1.0 | 1,960 | ||||||||||

| MINERAL RESERVE AND MINERAL RESOURCE STATEMENT | SILVER | |||||||||||||||

| INFERRED MINERAL RESOURCES (2,3,4,5,6,7,8,9,10,11) | ||||||||||||||||

| Kinross Gold Corporation's Share at December 31, 2025 | ||||||||||||||||

| Kinross | Inferred | |||||||||||||||

| Location | Interest | Tonnes | Grade | Ounces | ||||||||||||

| (%) | (kt) | (g/t) | (koz) | |||||||||||||

| Round Mountain | 7 | USA | 100% | 36,648 | 6.9 | 8,117 | ||||||||||

| Stockpile Inventory | ||||||||||||||||

| MINERAL RESERVE AND MINERAL RESOURCE STATEMENT | ||||||||||||||||

| STOCKPILE INVENTORY (INCLUDED IN PROVEN AND PROBABLE MINERAL RESERVES) (1,2,3,4,5,6,7) | ||||||||||||||||

| Kinross Gold Corporation's Share at December 31, 2025 | ||||||||||||||||

| Kinross | Proven | Probable | Proven and Probable | |||||||||||||

| Location | Interest | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | ||||||

| (%) | (kt) | (g/t) | (koz) | (kt) | (g/t) | (koz) | (kt) | (g/t) | (koz) | |||||||

| GOLD | ||||||||||||||||

| Round Mountain | 7 | USA | 100% | 5,365 | 0.3 | 59 | 0 | 0.0 | 0 | 5,365 | 0.3 | 59 | ||||

| See pages 13 and 14 of this news release for details of the footnotes referenced within the tables above. | ||||||||||||||||

Mineral Reserve and Mineral Resource Statement Notes

1) Unless otherwise noted, the Company's mineral reserves are estimated using appropriate cut-off grades based on an assumed gold price of $2,000 per ounce and a silver price of $23.53 per ounce. Mineral reserves are estimated using appropriate process recoveries, operating costs and mine plans that are unique to each property and include estimated allowances for dilution and mining recovery. Mineral reserve estimates are reported in contained units based on Kinross' interest.

2) The Company's mineral reserve and mineral resource estimates as at December 31, 2025 are classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") "CIM Definition Standards For Mineral Resources and Mineral Reserves" adopted by the CIM Council (as amended, the "CIM Definition Standards") in accordance with the requirements of National Instrument 43 101 "Standards of Disclosure for Mineral Projects" ("NI 43-101"). Mineral reserve and mineral resource estimates reflect the Company's reasonable expectation that all necessary permits and approvals will be obtained and maintained.

3) Cautionary note to U.S. investors concerning estimates of mineral reserves and mineral resources. These estimates have been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States' securities laws. Unless otherwise indicated, mining terms used herein and in any document incorporated by reference but not otherwise defined have the meanings set forth in NI 43-101. The terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Definition Standards. These definitions differ from the definitions in subpart 1300 of Regulation S-K ("Subpart 1300"). While the definitions in Subpart 1300 are similar to the definitions in NI 43-101 and the CIM Definitions Standard, the definitions in Subpart 1300 differ from the requirements of, and the definitions in, NI 43-101 and the CIM Definition Standards. U.S. investors are cautioned that while the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions in Subpart 1300 and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the mineral reserve or mineral resource estimates under the standards set forth in Subpart 1300. U.S. investors are also cautioned that while the United States Securities and Exchange Commission ("SEC") recognizes "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under Subpart 1300, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable. Further, "inferred mineral resources" have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of the "inferred mineral resources" exist. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. As a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the Subpart 1300 provisions and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. If the Company ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the multi-jurisdictional disclosure system, then the Company will be subject to reporting pursuant to the Subpart 1300 provisions, which differ from the requirements of NI 43-101 and the CIM Definition Standards.

For the above reasons, the mineral reserve and mineral resource estimates and related information herein may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

4) The Company's mineral resource and mineral reserve estimates were prepared under the supervision of and verified by Mr. Nicos Pfeiffer, who is a qualified person as defined by NI 43-101.

5) The Company's normal data verification procedures have been used in collecting, compiling, interpreting and processing the data used to estimate mineral reserves and mineral resource.

6) Rounding of values to the 000s may result in apparent discrepancies.

7) Round Mountain refers to the Round Mountain project, which includes the Round Mountain deposit and the Gold Hill deposit. The Round Mountain deposit does not contain silver and all silver resources at Round Mountain are contained exclusively within the Gold Hill deposit. Disclosure of gold mineral reserves and mineral resources reflect both the Round Mountain deposit and the Gold Hill deposit. Disclosure of silver mineral reserves and mineral resources reflect only the Gold Hill deposit.

8) Mineral resources are exclusive of mineral reserves.

9) Unless otherwise noted, the Company's mineral resources are estimated using appropriate cut-off grades based on a gold price of $2,500 per ounce and a silver price of $29.41 per ounce. Mineral resource estimates are reported in contained units based on Kinross' interest.

10) Mineral resources that are not mineral reserves do not have to demonstrate economic viability. Mineral resources are subject to infill drilling, permitting, mine planning, mining dilution and recovery losses, among other things, to be converted into mineral reserves. Due to the uncertainty associated with inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to indicated or measured mineral resources, including as a result of continued exploration.

11) The mineral resource estimates for Curlew assume a $2,000 per ounce gold price.

Mineral Reserve and Mineral Resource Statement Definitions

A ‘Mineral Resource' is a concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling.

An ‘Inferred Mineral Resource' is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

An ‘Indicated Mineral Resource' is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve.

A ‘Measured Mineral Resource' is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve.

A ‘Mineral Reserve' is the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at Pre-Feasibility or Feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a Mineral Reserve must be demonstrated by a Pre-Feasibility Study or Feasibility Study.

A ‘Probable Mineral Reserve' is the economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve.

A ‘Proven Mineral Reserve' is the economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors.

Cautionary statement on forward-looking information

All statements, other than statements of historical fact, contained or incorporated by reference in this news release including, but not limited to, any information as to the future financial or operating performance of Kinross, constitute "forward-looking information" or "forward-looking statements" within the meaning of certain securities laws, including the provisions of the Securities Act (Ontario) and the provisions for "safe harbor" under the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements contained in this news release include, without limitation, statements with respect to: the calculation of mineral reserves and resources at the projects and the possibility of eventual economic extraction of minerals from the projects; the potential identification of future mineral resources at the projects, including the potential for expanding the initial mineral resource and the potential for identifying additional mineralization in areas of intercepts and conceptual areas for extension and expansion; the Company's expectations and ability to convert existing mineral resources into categories of mineral resources or mineral reserves of increased geological confidence; all-in sustaining costs, mill throughput and average grades of the projects; impacts of the expansion projects on mine life, costs, production, production rates, margin, economics, grade, capital expenditures at the project-level or across the U.S. or Company-wide operations; future plans for exploration drilling; the projected economics of each project, including total production, margins, taxes, average annual production, the net present value of each project, the internal rate of return on each project, project payback period, average yearly free cash flow, life of mine unit costs, projected mine life, asset value, total capital required (both initial and sustaining); forecast design and mining methods of the projects; development timelines to production; the timing of and future prospects for exploration and any expansion of the projects, including exploration upside associated with the projects potential recovery rates or processing techniques; the Company's plan to self-fund the projects from operating cash flows; and references to the Company's future balance sheet, financial position and continued shareholder returns. The words "believe", "expect", "intends", "forecast", "future", "option", "plan", "potential", "prioritize", "proceed", "prospective", "target", "view" and "upside" or variations of or similar such words and phrases or statements that certain actions, events or results "may", "could", "will" or "would" occur, and similar expressions identify forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Kinross as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The estimates, models and assumptions of Kinross referenced, contained or incorporated by reference in this news release, which may prove to be incorrect, include, but are not limited to, the various assumptions set forth herein and in our Annual Information Form dated March 27, 2025 and our full-year 2024 Management's Discussion and Analysis as well as: (1) there being no significant disruptions affecting the activities of the Company whether due to extreme weather events and other or related natural disasters, labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; (2) permitting and development of the projects being consistent with the Company's expectations; (3) political and legal developments in the U.S. and Canada being consistent with its current expectations; (4) the accuracy of the current mineral resource and mineral reserve estimates of the Company (including but not limited to tonnage and grade estimates); (5) certain price assumptions for gold and silver and foreign exchange rates; and (6) inflation and prices for diesel, natural gas, fuel oil, electricity and other key supplies being approximately consistent with anticipated levels. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking statements made in this news release are qualified by these cautionary statements and those made in our other filings with the securities regulators of Canada and the United States including, but not limited to, the cautionary statements made in the "Risk Factors" section of our Annual Information Form dated March 27, 2025 and the "Risk Analysis" section of our full year 2024 Management's Discussion & Analysis. These factors are not intended to represent a complete list of the factors that could affect Kinross. Kinross disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward looking statements, except to the extent required by applicable law.

Certain forward-looking statements in this news release may also constitute a "financial outlook" within the meaning of applicable securities laws. A financial outlook involves statements about the Company's prospective financial performance, financial position or cash flows and is based on and subject to the assumptions about future economic conditions and courses of action and the risk factors described above in respect of forward-looking information generally, as well as any other specific assumptions and risk factors in relation to such financial outlook noted in this news release. Such assumptions are based on management's assessment of the relevant information currently available, and any financial outlook included in this news release is provided for the purpose of helping viewers understand the Company's current expectations and plans for the future. Readers are cautioned that reliance on any financial outlook may not be appropriate for other purposes or in other circumstances and that the risk factors described above, or other factors may cause actual results to differ materially from any financial outlook. The actual results of the Company's operations will likely vary from the amounts set forth in any financial outlook and such variances may be material.

Other information

Where we say "we", "us", "our", the "Company", or "Kinross" in this news release, we mean Kinross Gold Corporation and/or one or more or all of its subsidiaries, as may be applicable.

The technical information about the Company's mineral properties contained in this news release has been prepared under the supervision of Mr. Nicos Pfeiffer, an officer of the Company who is a "qualified person" within the meaning of National Instrument 43-101.

Source: Kinross Gold Corporation

_________________________________________

1 The economic analyses for the projects are preliminary in nature and are based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too geologically speculative to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that the economic forecasts on which the studies are based will be realized.

2 These figures are non-GAAP financial measures and ratios, as applicable. The definition and purpose of these non-GAAP financial measures and ratios are included on page 11 of this news release. Non-GAAP financial measures and ratios have no standardized meaning under IFRS and therefore, may not be comparable to similar measures presented by other issuers. Please see the Company's most recently filed Management's Discussion and Analysis for a reconciliation of the Company's attributable AISC and attributable capital expenditures figures to the related GAAP figures.

3 The economic analysis of the projects were carried out using a discounted cash flow approach on an after-tax basis, based on a long-term gold prices $4,300/oz. and $3,200/oz. in USD. The IRR on total investment that is presented in the economic analysis was calculated assuming 100% equity financing.

4 The NPV was calculated from the after-tax cash flow generated by the project, based on a discount rate of 5% and a valuation date of January 1, 2026.

5 Forecast 2026 attributable capital expenditures include Kinross' share of Manh Choh (70%) capital expenditures. Attributable capital expenditures are non-GAAP financial measures (refer to footnote 2). Notable assumptions used to forecast 2026 total attributable capital expenditures include an oil price of $70 per barrel, and foreign exchange rates of 5.25 Brazilian reais to the U.S. dollar, 940 Chilean pesos to the U.S. dollar, 40 Mauritanian ouguiyas to the U.S. dollar and 1.38 Canadian dollars to the U.S. dollar.

6 Average incremental Phase X production of approximately 140,000 Au eq. oz. per year is expected between 2029-2037.

7 Production cost of sales per equivalent ounce sold and production cost of sales per ounce sold are defined as production cost of sales divided by total gold equivalent ounces sold and production cost of sales divided by total gold ounces sold, respectively.

8 Average production cost of sales and average AISC represent costs for projected production for the life of mine.

9 See Appendix B for a complete summary of Round Mountain reserve and resource estimates including key assumptions.

10 Expected average gold production of approximately 100,000 Au oz. per annum for first five full years (2029-2033 as 2028 is a partial year).

11 Net cash is calculated as cash and cash equivalents less long-term debt (current and long-term portion).

12 "Available credit" is defined as available credit under the Company's credit facilities and is calculated in Section 6 Liquidity and Capital Resources of Kinross' MD&A for the three and nine months ended September 30, 2025.