Information

Third annual U.S. Automotive Brand Loyalty Analysis shows brand affinity remains steady despite higher vehicle prices, expanding EV options and shifting fuel incentives ATLANTA, Jan. 13, 2026 /PRNewswire/ --

Original sourceAI Summary

U.S. vehicle brand loyalty is steady at 51.4% for 2025. Higher vehicle prices and expanded EV options are impacting brand preferences. Affordability pressures affect consumer purchasing behavior in automotive sector. EV adoption is slower than expected, influencing loyalty metrics. LexisNexis harnesses data for insights in automotive and insurance industries.

Sentiment Rationale

The positive brand loyalty metrics suggest resilience in the automotive market, likely benefiting RELX through LexisNexis's analytics offerings.

Trading Thesis

As brand loyalty remains high, sustained demand for analytics will drive RELX's revenue growth over time.

Market-Moving

- U.S. vehicle brand loyalty is steady at 51.4% for 2025.

- Higher vehicle prices and expanded EV options are impacting brand preferences.

- Affordability pressures affect consumer purchasing behavior in automotive sector.

Key Facts

- U.S. vehicle brand loyalty is steady at 51.4% for 2025.

- Higher vehicle prices and expanded EV options are impacting brand preferences.

- Affordability pressures affect consumer purchasing behavior in automotive sector.

- EV adoption is slower than expected, influencing loyalty metrics.

- LexisNexis harnesses data for insights in automotive and insurance industries.

Companies Mentioned

- TSLA (TSLA)

- TM (TM)

- GM (GM)

Research Analysis

The insights provided by LexisNexis could enhance RELX's service value to automotive clients, linking directly to their analytics business.

Third annual U.S. Automotive Brand Loyalty Analysis shows brand affinity remains steady despite higher vehicle prices, expanding EV options and shifting fuel incentives

ATLANTA, Jan. 13, 2026 /PRNewswire/ -- LexisNexis® Risk Solutions, a leading provider of data and analytics for the insurance and automotive industries, announced that U.S. vehicle brand loyalty remains steady at 51.4% in 2025, according to its third annual U.S. Automotive Brand Loyalty Study. The year-end analysis shows brand affinity resilience as automakers navigate higher vehicle prices, expanding electric vehicle (EV) options and shifting fuel incentives. Through its automotive brand loyalty analysis, LexisNexis Risk Solutions provides automakers (OEMs) with a data-driven view of how U.S. consumers' purchasing and repurchasing behaviors are evolving across vehicle types and ownership cycles.

Key Takeaways

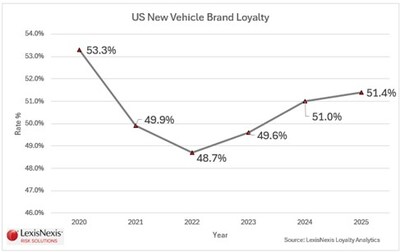

- U.S. vehicle brand loyalty hit a five-year high in 2025, reaching 51.4%, rising 0.4 percentage points year-over-year1.

- Ten automotive brands surpassed the industry-average vehicle brand loyalty rate of 51.4% in 2025.

- Fuel-type loyalty among EV repurchasers in 2025 fell from 82.7% in September to 58.3% in December, while gas loyalty rebounded from 80% to 83% in the same months following the expiration of federal EV tax credits.

- Affordability and macroeconomic pressures weighed on drivers, with average new vehicle prices surpassing $50,000 and incentives dropping to 6.7%2 of the average transaction price.

Key Observations

"Loyalty is reemerging as a critical competitive metric, with our analysis showing overall U.S. vehicle brand loyalty holding to 51.4% in 2025," said Dave Nemtuda, associate vice president, vehicle intelligence, LexisNexis Risk Solutions. "At the same time, performance across brands is far from uniform. Some automakers are pulling ahead through loyalty-driven strategies and stronger hybrid retention, while EV loyalty is becoming more fragmented as owners explore a growing number of electric options."

Brand Loyalty

To assess brand-level performance, LexisNexis Risk Solutions analyzed purchased vehicles in 2025, comparing newly purchased vehicles with those already owned in the garage.

- Toyota3 leads brand loyalty: Toyota closed 2025 as the industry loyalty leader, posting a 60.2% loyalty rate. Stronger hybrid retention supported this performance, with loyalty among Toyota hybrid owners increasing by 2.5 percentage points to 60.1%.

- Tesla4 loyalty softens amid rising EV competition: After ranking first or second in recent years, Tesla slipped to third place in 2025 with a 55.9% loyalty rate. Among EV owners replacing their vehicles with another EV, loyalty to Tesla declined as more consumers explored competing electric options.

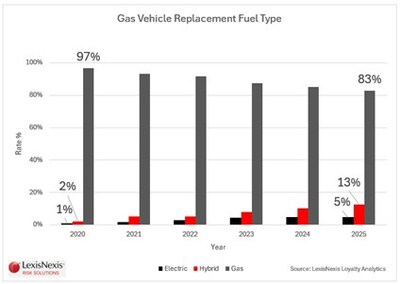

- Fuel-type dynamics reshape brand retention: While loyalty to gasoline as a fuel type jumped in the latter months of 2025, the long-term message is clear: owners are steadily replacing their gas vehicles with alternative fuel. In 2020, only 3% of those replacing their gas vehicle did so with alternative fuel. In 2025, alternative fuel vehicles accounted for 18% of all replacements of gasoline vehicles.5

Influencing Factors

Several macroeconomic and policy-driven factors influenced vehicle purchasing and repurchasing behavior in 2025.

- Affordability pressures persist: Average new vehicle prices crossed $50,000 as of September, while incentives declined to 6.7% of average transaction price, according to Cox Automotive6. Compact SUVs, one of the largest vehicle segments, faced higher tariffs and reduced incentives, creating affordability challenges that could affect future loyalty.

- Key segments remain resilient: Despite rising costs, loyalty increased in two of the largest vehicle segments. Large Pickup (54.8%) and Compact SUV (53.0%) loyalty rates were both up a percentage point year over year, finishing 2025 at their highest levels in years.

- EV adoption progresses more slowly than expected: Policy uncertainty, changes in emissions standards and incentive rollbacks contributed to a slower transition to EVs. EV brand loyalty edged down from 76% in 2024 to 73% in 2025, underscoring the need for automakers to adapt retention strategies as fuel preferences evolve.

- Ownership experience grows in importance: As EVs reduce routine dealer service visits, automakers are being pushed to rethink post-sale engagement and compete more directly on delivering value across the full ownership lifecycle.

Key Observations

"As automakers navigate shifting strategies and market conditions, consumers are feeling real pressure from higher vehicle prices, lower incentives and federal policy changes," said Mike Yakima, director, vehicle intelligence, LexisNexis Risk Solutions. "Brands that understand these crosscurrents and deliver value across the entire ownership journey, not just at the point of sale, will be best positioned to sustain and grow loyalty as the industry moves forward."

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data, sophisticated analytics platforms and technology solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit www.risk.lexisnexis.com, and www.relx.com.

CONTACT: Annalysce Baker, 1-678-436-1579, annalysce.baker@lexisnexisrisk.com

1See Figure 1 | ||||

2Cox Automotive: https://www.coxautoinc.com/insights-hub/sept-2025-atp-report/ | ||||

3All automaker brand names, logos and trademarks mentioned in this report are the property of their respective owners. Their inclusion is solely for identification, descriptive, and research purposes. This report does not imply any affiliation with, endorsement by, or sponsorship from the mentioned brands. All market data and analysis are based on independent research and are provided for informational purposes only. | ||||

4All automaker brand names, logos and trademarks mentioned in this report are the property of their respective owners. Their inclusion is solely for identification, descriptive, and research purposes. This report does not imply any affiliation with, endorsement by, or sponsorship from the mentioned brands. All market data and analysis are based on independent research and are provided for informational purposes only. | ||||

5See Figure 2 | ||||

6Cox Automotive: https://www.coxautoinc.com/insights-hub/sept-2025-atp-report/ | ||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/us-vehicle-brand-loyalty-climbs-to-five-year-high-in-2025-according-to-lexisnexisrisk-solutions-302658812.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/us-vehicle-brand-loyalty-climbs-to-five-year-high-in-2025-according-to-lexisnexisrisk-solutions-302658812.html

SOURCE LexisNexis Risk Solutions