AI and Stock News: A Game Changer for Investment Strategies

The Benefits of AI in Interpreting Financial News for Stock Investment

In today’s ever-changing stock market, staying informed is one of the most important factors for successful investing. Financial news plays a critical role in guiding investment decisions, but the overwhelming volume of information and the speed at which it is delivered can make it difficult for investors—especially retail investors—to stay on top of market-moving events. Fortunately, with the rise of Artificial Intelligence (AI) technologies, investors now have powerful tools at their disposal to interpret, filter, and act on financial news more effectively.

This article will explore how AI helps investors leverage financial news to make more informed decisions, why reading financial news is essential for stock investment, how to find reliable sources, and how technologies like AI can help transform news into actionable investment strategies.

Why Financial News Matters for Stock Investment

1. Understanding Market Trends and Economic Signals

For retail investors, staying updated on the latest financial news is a key way to identify market trends and economic signals. Whether it's an earnings report from a major corporation or a shift in government policy, financial news offers insights into the forces driving stock prices and entire markets. AI-powered tools can help by quickly analyzing news content, filtering out the noise, and highlighting relevant trends or economic signals that may affect stock prices.

For example, AI can sift through articles, financial statements, and social media to detect early warnings of a market shift, such as rising inflation or a company’s declining sales. This information, when interpreted effectively, can give investors a head start on market movements, helping them to act quickly before the broader market catches up.

2. Real-Time Reaction and Market Sentiment

The stock market is heavily influenced by sentiment—how investors feel about the market, sectors, or specific companies. Financial news plays a huge role in shaping market sentiment. News about a company's earnings, leadership changes, or product launches can create rapid changes in stock prices. However, for retail investors, it can be difficult to quickly evaluate the significance of these events.

AI technologies, such as sentiment analysis tools, can help investors process financial news in real-time. These AI tools analyze the tone of articles and social media mentions to assess the overall market sentiment around a particular stock or sector. If AI detects negative sentiment or a potential shift in the market, it can alert investors to adjust their portfolios accordingly—often before the news has fully impacted stock prices.

3. Risk Management and Portfolio Protection

Financial news often highlights risks, whether they come from economic developments, geopolitical events, or corporate mismanagement. For retail investors, recognizing these risks early can make the difference between protecting their investments and incurring heavy losses. AI can help by monitoring a range of news sources, financial reports, and even social media to spot emerging risks that may impact specific stocks or industries.

AI tools can scan news about changes in regulatory environments, potential supply chain disruptions, or company-specific risks—allowing investors to manage risk more effectively. By providing real-time insights, AI can help investors take action quickly, whether that means adjusting their holdings, diversifying their portfolio, or staying in cash until the risk is resolved.

4. Decoding Complex Financial Reports

For many retail investors, understanding the complexities of financial statements and earnings reports can be challenging. AI-driven tools can assist by automating the analysis of these reports and translating them into actionable insights. AI can automatically extract key financial metrics, compare them to market expectations, and assess the impact on a company’s stock price. For instance, AI can determine whether a company’s earnings beat or missed analyst expectations and predict the likely impact on its stock.

This means investors don’t need to be experts in finance to stay informed about corporate performance. With AI tools, complex data becomes accessible, and investment decisions can be based on clear, digestible information.

Finding Reliable Financial News Resources

As an investor, the reliability of the news you consume is crucial for making informed decisions. In today’s world, where information overload is a common problem, it’s essential to rely on trusted, accurate, and timely sources for financial news. But beyond simply relying on well-known platforms, it’s also important to use technologies like AI to enhance the accuracy and relevance of the news you receive.

Here are a few key factors to consider when selecting news sources and AI-powered tools:

1. Credibility and Accuracy

Make sure you are consuming news from credible, well-established sources. Platforms like Bloomberg, Reuters, and CNBC are known for their high-quality financial journalism. They also often integrate AI tools to help users analyze market data and news more efficiently. However, for retail investors, these resources can sometimes be overwhelming, and sifting through all the content can be time-consuming.

2. Real-Time Analysis and Personalization

One of the most effective ways to use AI in the investment process is by receiving personalized, real-time news updates tailored to your portfolio and investment strategy. AI can track the stocks you hold or are interested in, filtering news and updates that are directly relevant to you. This significantly reduces the noise and allows you to focus on what truly matters for your investments.

3. Data-Driven Insights

Reliable financial news sources not only provide breaking stories but also offer data-driven insights, including earnings reports, financial statements, and analyst ratings. Many AI-powered platforms can automatically process this data and provide you with actionable insights, such as whether a stock is under or overvalued based on current news.

4. Comprehensive Coverage

To stay fully informed, investors need access to a wide range of news sources, including market movements, geopolitical events, sector-specific news, and macroeconomic trends. AI-powered platforms can aggregate and synthesize news from multiple sources, giving you a broader perspective of the market and helping you spot patterns that may otherwise be missed.

How AI is Transforming Financial News into Actionable Investment Strategies

The real breakthrough for retail investors comes when AI helps transform financial news into actionable insights that can drive your investment strategy and execution. Let’s explore how AI-powered platforms can assist investors in interpreting news and making smarter, quicker decisions.

1. AI-Powered Sentiment Analysis

One of the most powerful tools that AI offers is sentiment analysis. By using AI algorithms to scan thousands of news stories, social media posts, and analyst opinions, sentiment analysis tools can gauge the overall mood around a particular stock or sector. For example, if a company is getting positive mentions in the media and analysts are optimistic about its future, the AI tool can detect this trend and suggest it might be a good time to buy. Conversely, if a company faces negative sentiment (e.g., due to regulatory issues or product recalls), AI can warn investors to be cautious.

AI-powered sentiment tools can also provide real-time updates on breaking news, allowing you to quickly assess how market sentiment is shifting and adjust your portfolio accordingly.

2. Predictive Analytics

AI doesn't just analyze past and present data—it can also predict future trends. By processing historical data, news sentiment, and market conditions, AI algorithms can generate predictive models that forecast the likely direction of stock prices. For instance, AI could predict that a stock is likely to rise based on strong earnings reports and positive news from the industry. Predictive analytics can be a game-changer for retail investors, helping them to time market entries and exits more effectively.

3. Automated Trading and Strategy Execution

Some advanced AI platforms are integrated with trading algorithms, enabling automated strategy execution. Once an AI tool interprets financial news and generates an actionable strategy, it can automatically place trades on your behalf. For example, if AI detects that a stock has risen above a certain price point following positive earnings reports, it can automatically trigger a buy order. This helps retail investors act fast and capitalize on market opportunities without delay.

4. Portfolio Optimization

AI can also help optimize your investment portfolio by analyzing how your stocks are performing in relation to the latest news. Using AI-powered platforms, you can receive insights into which assets might be underperforming due to recent news events or shifts in sentiment, prompting you to make portfolio adjustments. AI can recommend diversifying your holdings or reallocating funds to different sectors based on evolving news trends.

AI Platforms for Investors: Transforming Financial News into Smart Investment Decisions

Several platforms are at the forefront of using AI to help investors better receive, interpret, and act on financial news. These platforms combine advanced data analysis, sentiment tracking, and predictive analytics to help investors stay informed and make more strategic investment decisions.

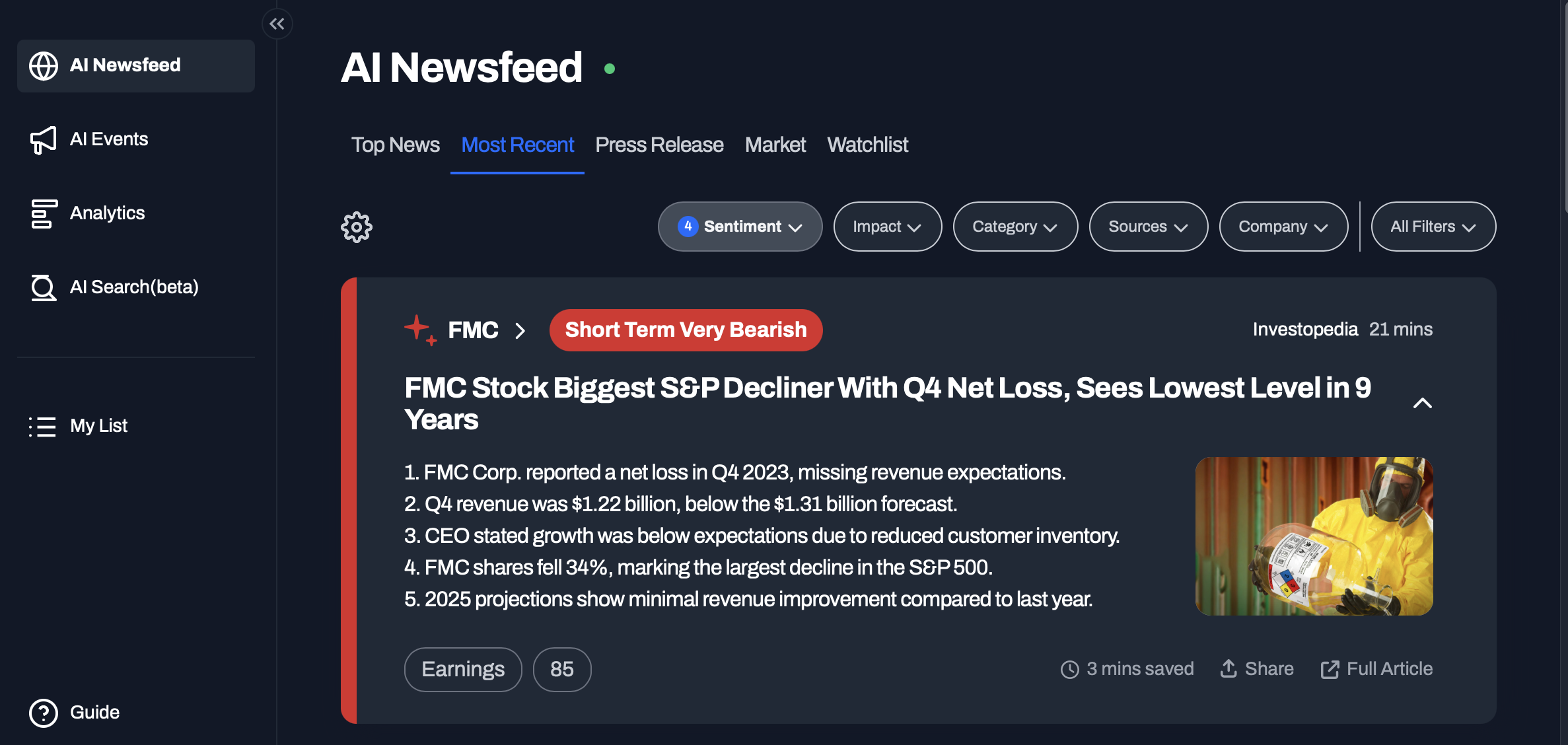

1. StockNews.AI

One such platform is StockNews.AI, which provides real-time, AI-driven insights into stock performance based on the latest news, market data, and sentiment analysis. StockNews.ai uses AI to analyze and summarize financial news and predict stock price movements, providing personalized alerts to help investors make timely decisions. By combining financial news analysis with actionable data, the platform helps retail investors create and execute smarter investment strategies.

Key Features include:

- Real-time AI-powered news analysis

- Sentiment tracking and stock predictions

- Personalized alerts and actionable insights

- In-depth coverage of stock performance

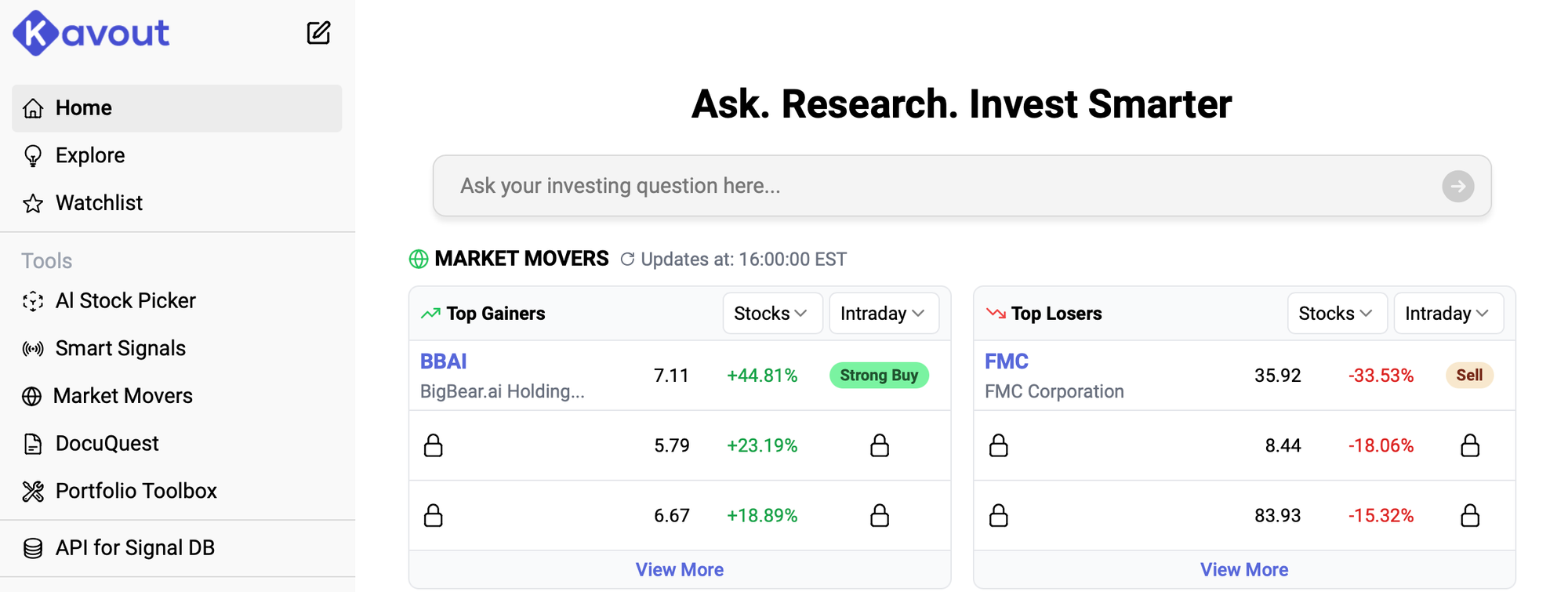

2. Kavout

Kavout is another platform that uses AI to combine financial data and market news for predictive insights. Their proprietary "Kai" AI system analyzes thousands of data points, including financial news, to forecast stock performance. Kavout aims to help investors by providing stock rankings, alerts, and automated trading strategies based on its deep learning models.

Key Features include:

- AI-driven predictive stock ranking system

- Customizable trading strategies

- Market tracker for investment decisions

- Integration with brokerage accounts for automated trading

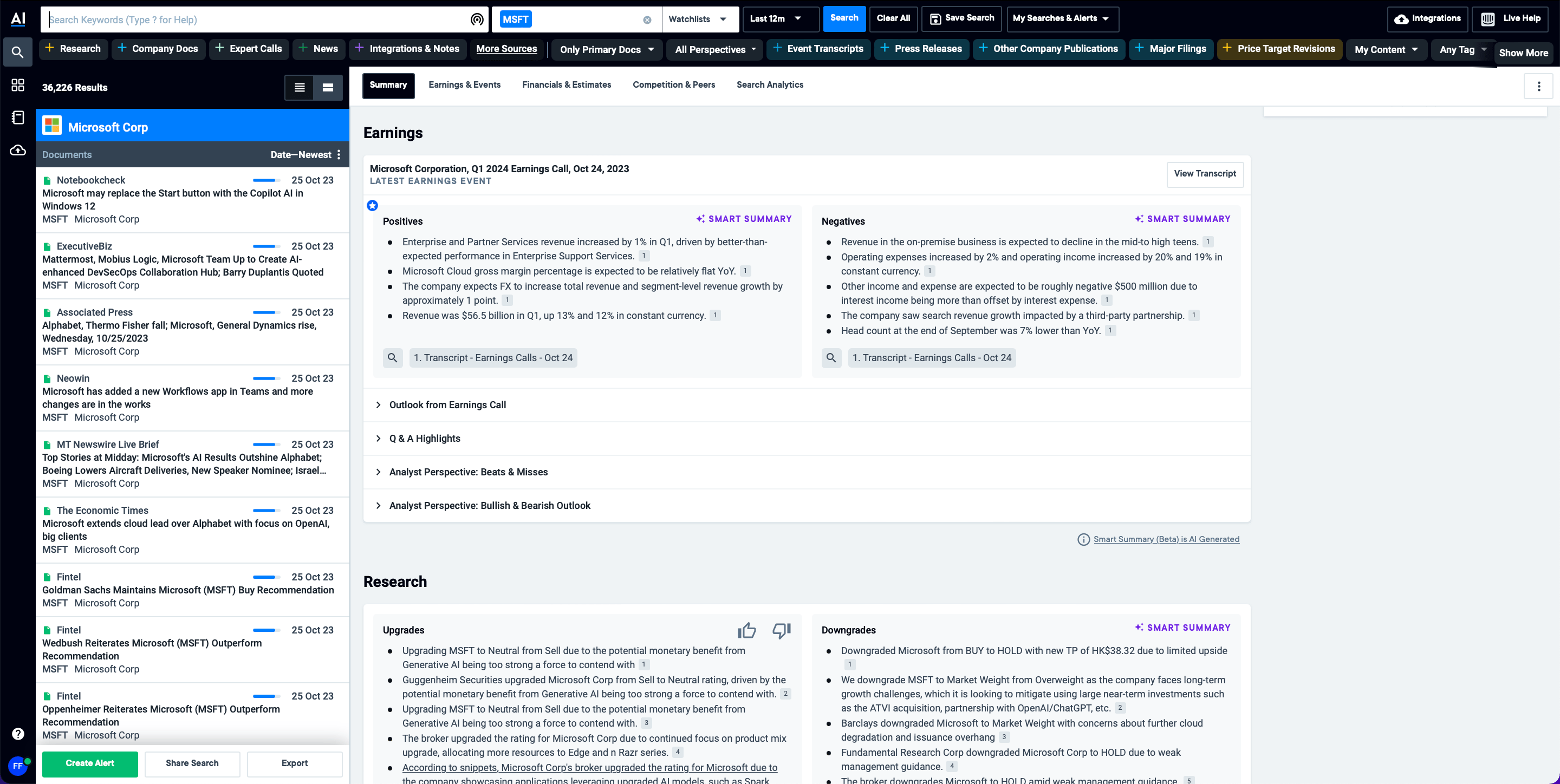

3. AlphaSense

AlphaSense leverages AI to scan financial documents and news for critical insights that could affect market behavior. It provides investors with a platform to search earnings calls, SEC filings, and other relevant data sources, all powered by AI to surface actionable information that might influence investment decisions. AlphaSense is especially useful for institutional investors and analysts, as it allows them to track multiple sources of financial news and documents in real time.

Key Features include:

- AI-powered document and earnings call analysis

- Real-time tracking of market-moving news

- Customizable alerts based on specific keywords or topics

- Advanced search and filtering capabilities for financial documents

4. Trade Ideas

Trade Ideas is an AI-powered trading platform that helps investors by providing real-time trade ideas, alerts, and market scans. Using AI technology, it can automatically analyze a variety of factors like technical indicators, earnings reports, and news to suggest potential trades. Trade Ideas also offers a virtual trading assistant, "Holly," that simulates multiple strategies to find profitable opportunities in the market.

Key Features of Trade Ideas:

- AI-driven trade alerts and strategy suggestions

- Real-time stock scanning based on news and market data

- Virtual trading assistant for strategy testing

- Backtesting capabilities for refining trading strategies

5. Tickeron

Tickeron is another powerful AI tool focused on stock trading. It uses AI to analyze millions of data points, including stock news, technical patterns, and financial reports. Tickeron offers both AI-powered stock and ETF trade recommendations, as well as detailed market scans. Investors can rely on its trend recognition and pattern-matching algorithms to make smarter decisions.

Key Features of Tickeron:

- AI-powered market scans and trade recommendations

- Pattern recognition tools for stocks and ETFs

- Customizable trading strategies based on real-time data

- Portfolio management and risk assessment tools

AI-Powered Investment Platforms: Feature Comparison

Explore how leading AI-driven investment tools stack up against each other, helping you choose the best platform for your trading and analysis needs.

| Feature | StockNews.AI | Kavout | AlphaSense | Trade Ideas | Tickeron |

|---|---|---|---|---|---|

| AI News Analysis | ✔ | ||||

| Stock Predictions | ✔ | ✔ | |||

| Personalized Alerts | ✔ | ||||

| Customizable Strategies | ✔ | ✔ | ✔ | ||

| Market Tracking | ✔ | ✔ | ✔ | ||

| Brokerage Integration | ✔ | ||||

| Document Analysis | ✔ | ||||

| Virtual Assistant | ✔ | ||||

| Pattern Recognition | ✔ | ||||

| Portfolio Management | ✔ |

Conclusion

Incorporating AI into your investment strategy can transform how you navigate financial markets. By leveraging AI-powered tools, investors can swiftly analyze market-moving news, predict stock trends, and make data-driven decisions with greater confidence. As AI continues to reshape the investment landscape, embracing these innovations can give you a competitive edge. Explore the best AI-driven platforms and harness their full potential to optimize your investment strategy.