Market Sentiment in Stock Trading -- 5 Tools You Need to Know in 2025

"Market sentiment is the heartbeat of stock trading—understand it, and you can anticipate the market's next move."

Introduction

In the fast-paced world of stock trading, sentiment plays a crucial role in influencing price movements. Traders and investors who understand how to interpret market sentiment can gain a competitive edge, especially when analyzing corporate actions such as mergers and acquisitions (M&A), share buybacks, earnings announcements, and dividend policies. This article explores how traders leverage these events and the top 5 recommended tools to make informed investment decisions.

Understanding Market Sentiment

Market sentiment refers to the overall attitude of investors toward a particular security or the broader financial market. This sentiment can be bullish (positive) or bearish (negative) and is often driven by news, earnings reports, macroeconomic indicators, and corporate actions. While fundamental and technical analysis remain key pillars of trading, incorporating sentiment analysis can provide an additional layer of insight into stock movements.

In general, four key corporate actions drive sentiment significantly:

| Corporate Action | Biggest Feature |

|---|---|

| Mergers and Acquisitions (M&A) | Can increase volatility, with the acquirer’s stock often declining and the target’s stock surging. |

| Share Buybacks | Signals confidence, reduces outstanding shares, and boosts earnings per share (EPS). |

| Earnings Announcements | Cause significant price swings, with forward guidance often outweighing actual results. |

| Dividend Announcements & Cuts | Dividend increases boost confidence, while cuts signal financial distress and lead to sell-offs. |

1. Mergers and Acquisitions (M&A)

M&A activities significantly impact stock prices, often increasing volatility and trading opportunities. Here’s how traders can interpret these events:

- Acquirer’s Stock: The acquiring company’s stock often declines if the market perceives the acquisition as overpriced or detrimental to its financials.

- Target’s Stock: The target company’s stock usually surges upon announcement, as buyers often offer a premium over the market price.

- Sector-Wide Effects: M&A announcements can lift an entire sector, as investors speculate on further consolidation.

- Regulatory Risk: Sentiment can turn bearish if regulatory bodies challenge the merger due to antitrust concerns.

🔥Real-time Mergers and Acquisitions Events

2. Share Buybacks

When companies repurchase their own shares, they signal confidence in future growth and profitability. This often leads to a positive sentiment shift, causing stock prices to rise. Key considerations include:

- Increased Earnings Per Share (EPS): Fewer shares outstanding can boost EPS, making the stock more attractive.

- Market Perception: If the buyback is seen as a strategic move rather than a desperate attempt to prop up shares, it can drive bullish momentum.

- Timing: Buybacks during market downturns indicate strong financial health and can fuel a price rebound.

💥AI-Powered Share Buyback Activities

3. Earnings Announcements

Quarterly earnings reports can cause dramatic price swings depending on whether results beat, meet, or miss analyst expectations. Traders should watch for:

- Guidance Over Results: Even strong earnings can lead to sell-offs if forward guidance is weak.

- Earnings Surprises: Unexpectedly strong or weak results can lead to sharp price movements due to changes in sentiment.

- Sector and Market Impact: Major companies in an industry can set the tone for sector-wide sentiment.

📢AI Monitors Earnings Announcement

4. Dividend Announcements and Cuts

Dividend changes can shift investor sentiment significantly:

- Increases in Dividends: Often seen as a sign of financial stability, boosting investor confidence.

- Dividend Cuts or Suspensions: Generally negative, signaling financial distress and leading to sell-offs.

⚡️AI Tracked Dividend Change Events

Strategies to Trade on Sentiment

Sentiment trading strategies are investment approaches that analyze the collective mood and emotions of market participants to capture mispricings and trends. By interpreting signals from news, social media, and technical indicators, these strategies aim to anticipate market moves and profit from them. Among the various strategies available, several stand out due to their widespread popularity and effectiveness.

| Trading Strategy | Pros | Cons |

|---|---|---|

| Contrarian Trading | High return potential from market overreactions. | Risk of mistiming and extended downturns. |

| Momentum Trading | Profits from strong, clear trends. | Vulnerable to reversals and false signals. |

| Event-Driven Trading | Quick profits from major market events. | Requires real-time news tracking. |

| Social Media Sentiment Analysis | Early insight into emerging trends. | Prone to noise and manipulation. |

| Options Trading Strategies | Hedges risk with high return potential. | Complex execution and time decay risk. |

- Contrarian Trading is based on the “buy low, sell high” principle, where traders go against prevailing sentiment. They purchase assets when negative sentiment drives prices down and sell when overly optimistic sentiment inflates prices. This approach is popular because it capitalizes on market overreactions, though it requires careful timing to avoid further downturns. Contrarian traders often use indicators such as the Fear & Greed Index and put-call ratios to identify extreme sentiment trends.

- Highlight: Works best in markets where emotions significantly drive asset prices.

✔ Pros: Potential for high returns by exploiting market overreactions.

✖ Cons: Risk of prolonged adverse trends and mistiming the market.

- Momentum Trading involves riding the wave of prevailing sentiment by buying assets when positive momentum is identified and selling as the trend reverses. Traders use technical indicators such as the Relative Strength Index (RSI), Moving Averages, and Volume Weighted Average Price (VWAP) to identify trending stocks. This strategy is popular because it is straightforward and aligns with the natural tendency of trends to persist.

- Highlight: Effective in rapidly trending markets, particularly when supported by robust technical indicators.

✔ Pros: Capitalizes on clear, directional movements in the market.

✖ Cons: Vulnerable to sudden reversals and false signals.

- Event-driven trading focuses on major corporate events such as M&A announcements, earnings reports, product launches, and regulatory approvals to identify trading opportunities. Traders monitor news sentiment and volume surges to enter or exit positions quickly, aiming to capture price swings triggered by market reactions. This strategy is widely used due to the predictability of event-driven volatility, though it demands constant vigilance and real-time news tracking.

- Highlight: Best suited for traders who can process breaking news efficiently and act decisively.

✔ Pros: Can yield significant short-term profits by leveraging major market-moving events.

✖ Cons: Requires staying updated with news sources and economic calendars to react swiftly.

- Social Media Sentiment Analysis employs tools to gauge public opinion on platforms like Twitter or Reddit. This modern approach captures grassroots sentiment that can precede broader market moves. Its popularity has surged with the rise of social media, though it demands sophisticated data analytics.

- Highlight: Ideal for traders looking to harness the power of crowd-sourced sentiment data.

✔ Pros: Provides early insights into emerging trends and public opinion.

✖ Cons: Susceptible to noise and manipulation; not all sentiment is indicative of market fundamentals.

- Options Trading Strategies leverage call and put options to capitalize on sentiment-driven price movements while managing risk. Traders anticipating bullish sentiment often buy call options to profit from expected price increases, whereas those expecting bearish sentiment may buy put options or sell covered calls to hedge against potential declines. Additionally, traders use volatility plays, such as straddles and strangles, to take advantage of major corporate events where significant price swings are expected but the direction remains uncertain. This strategy is popular because it offers flexibility and defined risk, though it requires a strong understanding of options mechanics.

- Highlight: Ideal for traders who want to capitalize on volatility with controlled risk exposure.

✔ Pros: Offers hedging capabilities and potential for high returns with limited capital.

✖ Cons: Complexity in execution; option premiums can erode profits if price movement is insufficient.

Each strategy leverages a different facet of market sentiment, offering unique advantages and challenges. Their popularity lies in the potential to outperform traditional analysis by tapping directly into the collective psychology of the market. However, success often depends on the trader’s ability to manage risk and react quickly to changing conditions.

5 Useful Tools for Sentiment-Based Trading

To enhance sentiment analysis, traders can leverage the following tools:

StockNews.AI

StockNews.AI is an AI-driven trading intelligence platform that analyzes real-time news sentiment, earnings reports, and financial trends to identify investment opportunities. It provides a predictive edge by interpreting market sentiment and highlighting high-probability bullish or bearish signals.

Key Features:

✔ AI-powered sentiment analysis of financial news and reports.

✔ Predictive analytics for stock price movements based on sentiment shifts.

✔ Customizable real-time alerts on market-moving trends.

✔ AI-driven portfolio insights and stock recommendations.

Pros:

✔ Provides deep, data-driven insights into sentiment trends.

✔ Covers a broad range of financial events for a holistic market view.

✔ Real-time alerts help traders react quickly to market shifts.

Cons:

✖ Subscription-based with limited free access.

✖ AI-driven predictions require human validation for accuracy.

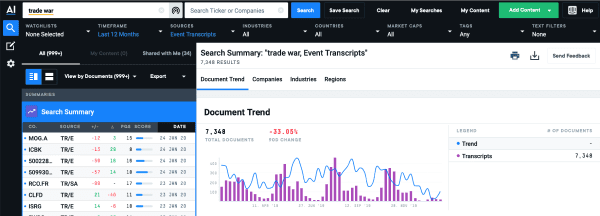

AlphaSense

AlphaSense is a premium AI-powered financial research platform designed for institutional investors. It uses Natural Language Processing (NLP) to extract sentiment and insights from earnings calls, SEC filings, research reports, and financial news.

Key Features:

✔ AI-driven search across earnings transcripts, regulatory filings, and market research.

✔ Sentiment scoring from analyst calls and corporate disclosures.

✔ Real-time data extraction for faster investment decision-making.

Pros:

✔ High-quality institutional-grade financial insights.

✔ Advanced NLP models enhance text-based sentiment analysis.

Cons:

✖ Premium pricing, primarily suited for hedge funds and professional investors.

✖ Requires expertise in financial statements for optimal use.

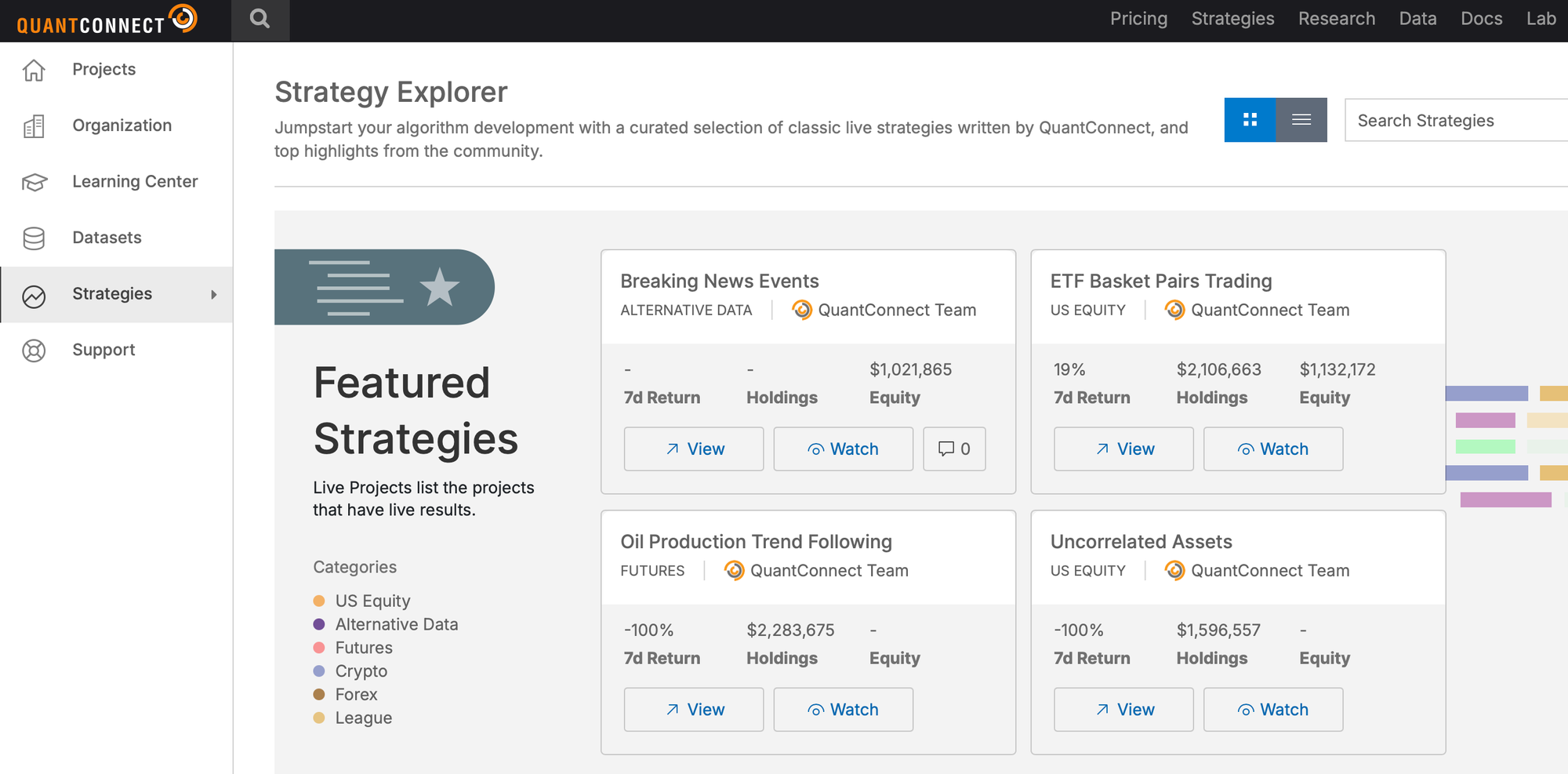

QuantConnect

QuantConnect is a cloud-based algorithmic trading platform that enables investors, quants, and developers to design, test, and deploy trading strategies using a vast range of financial data. One of its powerful capabilities is leveraging market sentiment analysis for stock investment, allowing traders to integrate alternative data sources — such as news sentiment, social media trends, and earnings reports—into their quantitative models.

Key Features:

✔ Provides tools to analyze textual data for sentiment scoring and predictive modeling.

✔ Allows users to test sentiment-based trading strategies against historical data to refine performance.

✔ Offers LEAN, an open-source algorithmic trading engine, for customizable development.

Pros:

✔ Cloud-based execution enables running large-scale sentiment analysis strategies efficiently.

✔ A strong developer community and open-source framework for collaborative improvements.

✔ Supports Python and C# for building complex sentiment-driven models.

Cons:

✖ Requires strong programming and quantitative finance knowledge.

✖ Access to premium sentiment datasets may require additional fees.

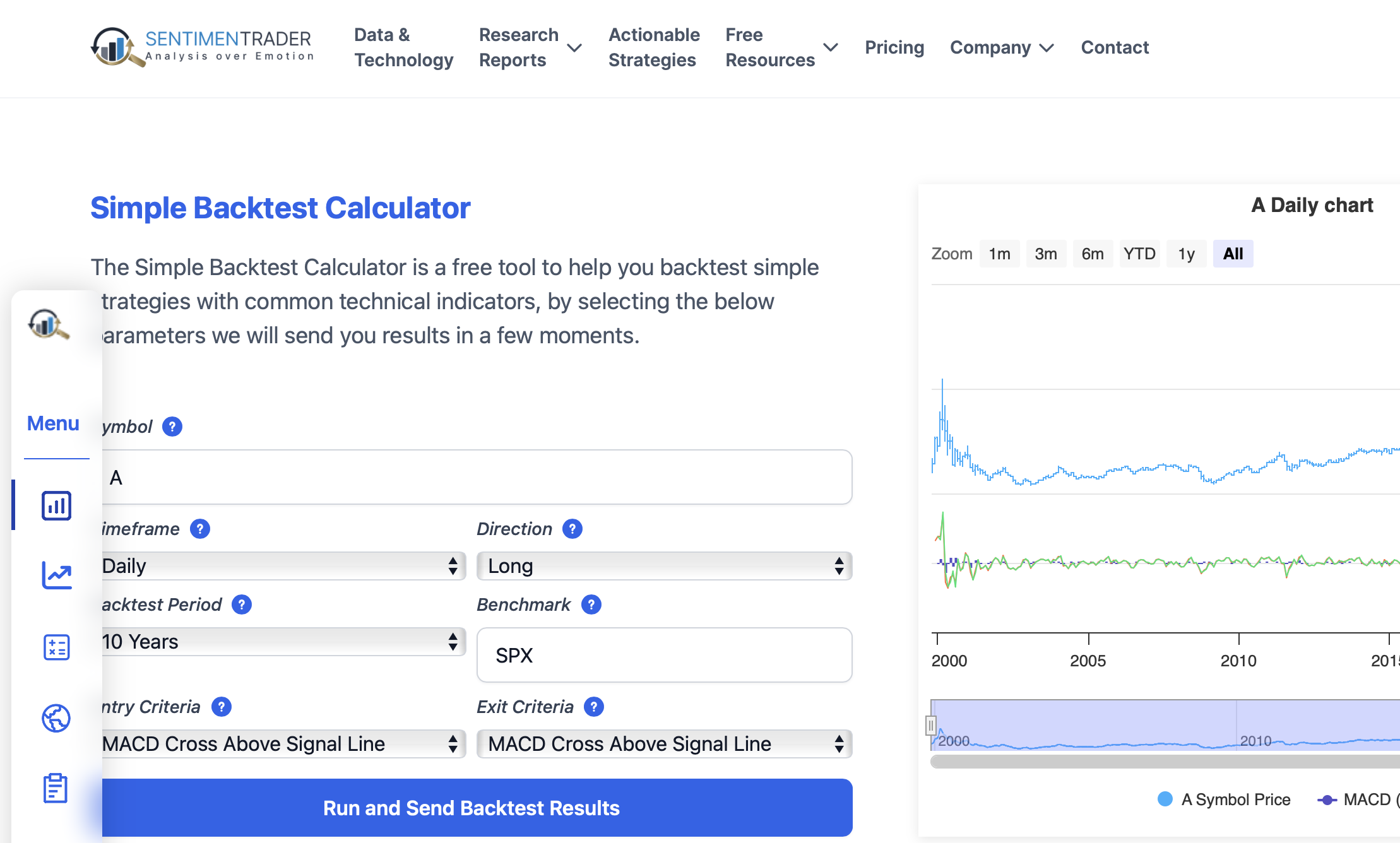

SentimenTrader

SentimenTrader specializes in quantifying investor sentiment by aggregating historical data and proprietary sentiment indicators. It is widely used for both short-term trading and long-term investment analysis.

Key Features:

✔ Comprehensive sentiment scores based on historical market data.

✔ Backtesting tools to refine sentiment-driven trading strategies.

✔ A wide array of sentiment-based indicators tailored for different markets.

Pros:

✔ Useful for both tactical traders and strategic investors.

✔ Strong historical datasets for in-depth sentiment research.

Cons:

✖ Requires prior knowledge of sentiment-based trading strategies.

✖ More useful for analysis than real-time trade execution.

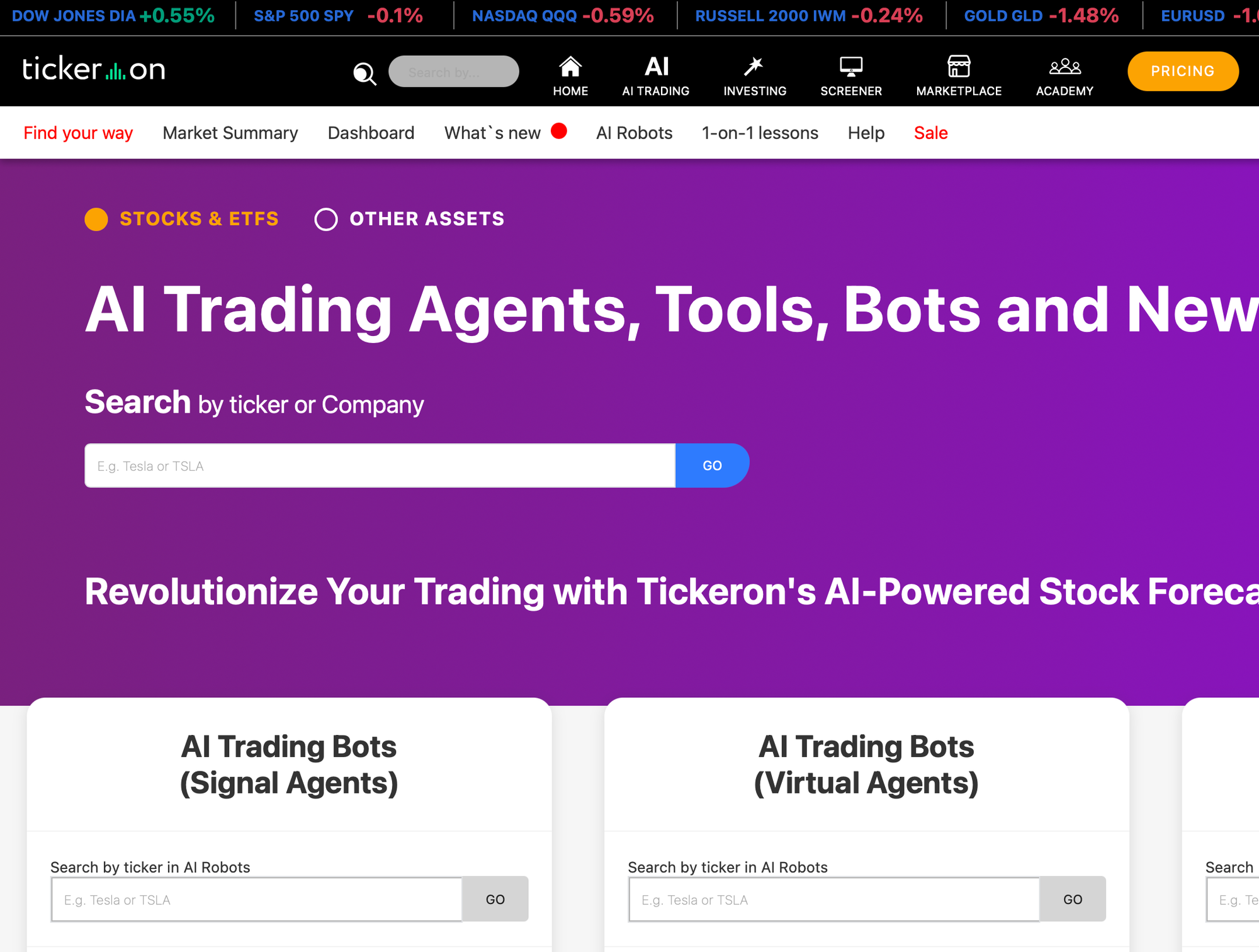

Tickeron

Tickeron is an AI-powered trading platform that integrates sentiment analysis with pattern recognition and social trading features. It provides AI-driven trade signals while allowing traders to collaborate and share insights.

Key Features:

✔ AI-based pattern recognition for technical and sentiment trends.

✔ Community-driven sentiment insights with social trading integration.

✔ Customizable trading signals tailored to individual strategies.

Pros:

✔ AI-generated trade signals enhance sentiment-based decision-making.

✔ Community engagement provides additional market perspectives.

Cons:

✖ AI signals require human validation to avoid false alerts.

✖ Community-based insights can be biased or influenced by groupthink.

Challenges & Limitations of Sentiment-Based Trading

Sentiment-based trading can provide valuable insights into market trends, but it also comes with inherent risks and challenges. Because sentiment is often driven by emotions, news cycles, and social media trends, it can be unpredictable and prone to manipulation. Traders relying solely on sentiment indicators must navigate short-term volatility, false signals, and external market forces that can disrupt their strategies. Below are some of the key challenges sentiment traders face:

- Short-Term Volatility

Market sentiment can shift rapidly due to news events, rumors, or sudden investor reactions. Price swings can be unpredictable, making it difficult to execute trades with precision. Additionally, high-frequency trading (HFT) algorithms often amplify volatility, making it harder for retail traders to keep up.

- False Signals

Sentiment indicators, such as social media trends or news sentiment, can produce misleading signals. Also, herd behavior and emotional trading can create artificial price movements that don’t reflect actual fundamentals.

- Regulatory & External Factors

Government policy changes, central bank decisions, and unexpected regulations can disrupt sentiment-driven trends. Macroeconomic shocks (e.g., interest rate hikes, recessions, geopolitical conflicts) can also override market sentiment.

- Data Accuracy & Interpretation

Sentiment analysis relies on unstructured data (e.g., news articles, tweets, forum discussions), which can be difficult to interpret correctly. Importantly, algorithms analyzing sentiment can misjudge sarcasm, irony, or misinformation, leading to poor trading decisions.

Conclusion

Market sentiment is a powerful force that can significantly influence stock prices, especially during key corporate actions such as mergers and acquisitions, share buybacks, earnings announcements, and dividend changes. By integrating sentiment analysis with traditional trading strategies, investors can gain an edge in identifying market trends and making informed decisions. Various sentiment-based trading strategies, including contrarian trading, momentum trading, event-driven trading, social media sentiment analysis, and options trading, offer distinct advantages but also come with inherent risks, such as false signals and short-term volatility.

To navigate sentiment-driven markets effectively, traders can leverage advanced tools like StockNews.AI, AlphaSense, QuantConnect, SentimenTrader, and Tickeron, each offering unique capabilities for sentiment analysis, predictive modeling, and real-time alerts. However, sentiment-based trading is not without challenges—factors such as regulatory shifts, macroeconomic events, and data misinterpretation can lead to unexpected market reactions. While sentiment analysis enhances investment strategies, successful implementation requires a balanced approach that combines data-driven insights with risk management techniques.