How to Start Investing -- Best Tools for Retail Investors

Introduction

Investing in financial markets has evolved significantly, driven by technological advancements that have reshaped how both retail and institutional investors operate. While both groups now have access to powerful tools and vast amounts of market data, key differences remain in their strategies, decision-making processes, and access to resources. These distinctions influence everything from risk management to trading efficiency, market psychology, and long-term financial outcomes.

Retail investors, often individual traders, typically rely on accessible trading platforms, social sentiment, and personal research, while institutional investors leverage sophisticated algorithms, vast capital reserves, and exclusive market opportunities. Additionally, the psychological aspects of investing—such as emotional bias, herd mentality, and behavioral trends—affect each group differently, shaping their approach to market fluctuations and investment strategies.

Understanding these differences is crucial for investors looking to optimize their decision-making and leverage the right tools for success. This article explores the distinctions between retail and institutional investors, their respective strategies, the technologies they employ, the role of market psychology, and future trends shaping the investing landscape

Understanding Retail and Institutional Investors

Who Are Retail Investors?

Retail investors are individual investors who trade securities for personal accounts rather than for an institution. These individuals typically invest in a variety of assets, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and even cryptocurrencies. Unlike institutional investors, retail investors usually have less capital and rely on publicly available information, investment apps, and financial news sources to guide their decisions.

Key Characteristics of Retail Investors:

- Capital Size: Retail investors typically invest smaller amounts compared to institutional investors.

- Decision-Making: These investors make decisions based on personal financial goals, market sentiment, and often follow market news.

- Investment Platforms: Retail investors use brokerage accounts, robo-advisors, and stock analysis tools like StockNews.AI, Yahoo Finance, or Seeking Alpha.

- Emotional Trading: Retail investors can be more prone to emotional trading due to external factors such as news reports, social media trends, and market psychology.

- Goals: Retail investors often focus on personal financial goals, such as retirement planning, wealth building, or securing short-term gains.

Who Are Institutional Investors?

Institutional investors, on the other hand, are large organizations that manage investments on behalf of clients or large funds. These include hedge funds, pension funds, mutual funds, insurance companies, and university endowments. These investors typically have access to more capital, private data, and sophisticated research, giving them an edge in the market.

Key Characteristics of Institutional Investors:

- Capital Size: Institutional investors manage large amounts of capital, often in the billions.

- Data Access: They rely on proprietary research, private data, and advanced analytics tools.

- Trading Algorithms: Institutions often employ advanced trading algorithms and quantitative models to execute trades efficiently.

- Market Influence: Due to the volume of their trades, institutional investors can significantly influence market prices and trends.

- Team-Based Decision Making: Investment decisions are often made by teams, including experts in risk management, research, and portfolio allocation.

Investment Strategies: Retail vs. Institutional Investors

Retail Investors’ Strategies

Retail investors generally use a combination of fundamental and technical analysis to guide their investment decisions. They tend to focus on personal financial goals and shorter-term market trends. Some of the most common retail investing strategies include:

- Buy and Hold: Investing in stable, long-term assets like blue-chip stocks or ETFs with the goal of accumulating wealth over time. This strategy focuses on patience and the belief that long-term investments will yield consistent returns.

- Growth Investing: This involves investing in companies expected to grow at an above-average rate compared to others in the market. Sectors like technology, healthcare, and renewable energy are often popular choices for growth investors.

- Dividend Investing: A strategy that focuses on buying stocks that pay dividends. Retail investors seek steady income from dividends in addition to capital appreciation.

- Day and Swing Trading: These short-term strategies capitalize on market fluctuations within the day or over several days. Day trading focuses on quick profits, while swing trading aims to profit from short-term market trends.

- Thematic Investing: Involves identifying emerging market trends or sectors like artificial intelligence (AI), clean energy, or blockchain technology. Investors adopt these strategies to capitalize on potential future growth.

Institutional Investors’ Strategies

Institutional investors have access to more advanced tools and resources, allowing them to employ more complex investment strategies. These strategies typically involve leveraging large amounts of data, sophisticated algorithms, and a more diversified portfolio.

- Quantitative Trading: Institutions use algorithms and machine learning to identify patterns in market behavior. These models often rely on vast amounts of data to predict market trends and execute trades automatically.

- Arbitrage Trading: This strategy takes advantage of price discrepancies between two or more markets. Institutions can quickly identify and exploit inefficiencies in global markets, providing a risk-free profit.

- Portfolio Optimization: Institutions seek to balance risk and reward by diversifying investments across asset classes. They use complex mathematical models to optimize their portfolios and minimize risks.

- Private Equity and Venture Capital: Institutional investors often invest in private companies or startups before they go public. These investments are typically riskier but can offer significant returns if successful.

- Derivative Strategies: Institutions use derivatives like options, futures, and swaps to hedge against risks and enhance returns. These tools allow institutions to manage complex risk factors in their portfolios.

Tools for Retail Investors

Retail investors rely on a range of platforms and tools to stay informed about market trends, analyze stocks, and execute trades. Some of the most widely used platforms for retail investors include:

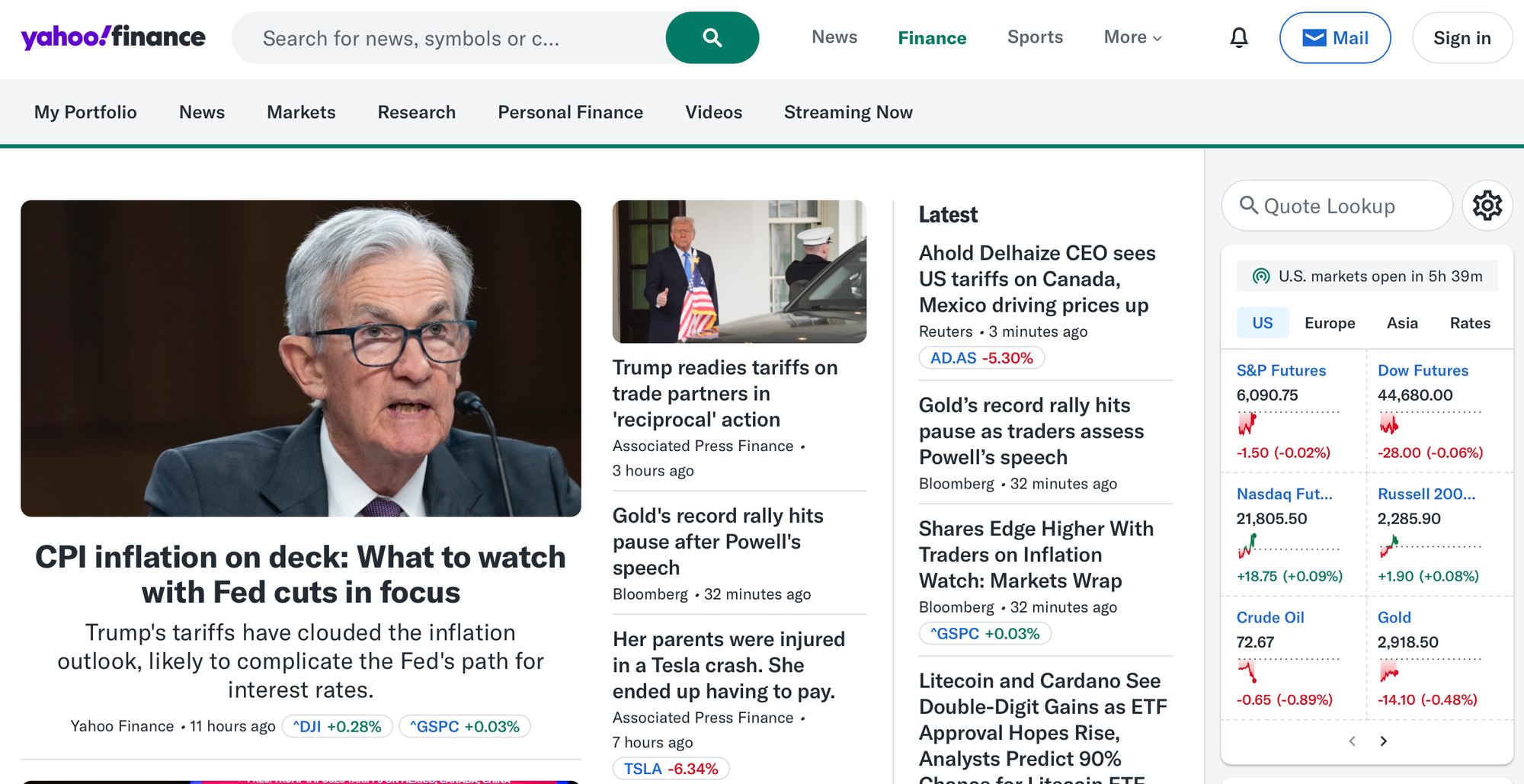

Yahoo Finance: Market News and Research

Yahoo Finance provides market news, real-time stock quotes, and financial analysis. Retail investors use Yahoo Finance for tracking stock performance, earnings reports, and overall market conditions.

Seeking Alpha: Crowdsourced Investment Analysis

Seeking Alpha allows retail investors to access crowdsourced stock analysis, research reports, and market outlooks. It brings together professional analysts and individual investors to provide diverse perspectives on investment strategies.

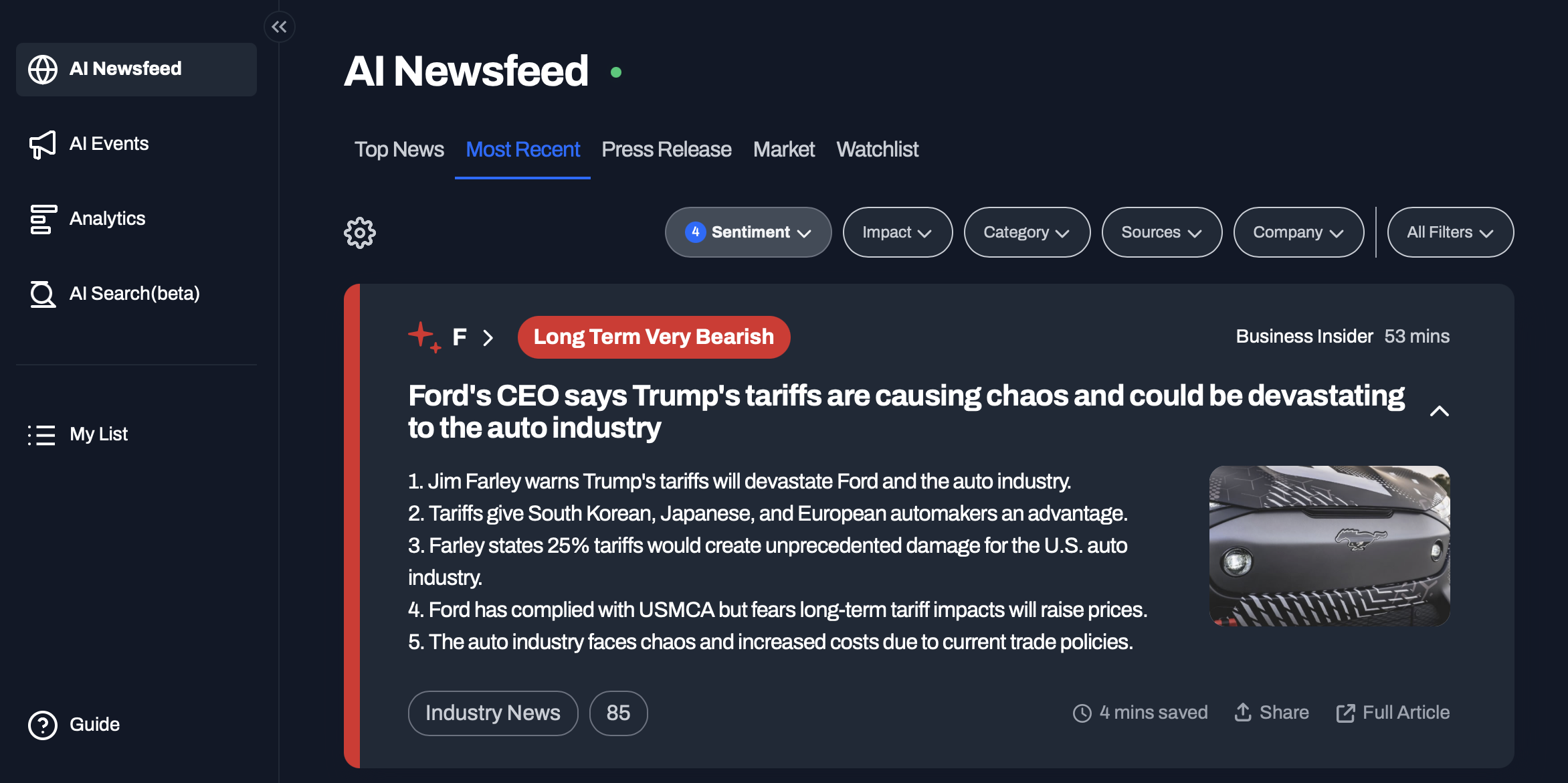

StockNews.AI: AI-Powered Investment Insights

StockNews.AI summarizes complex financial news, offering quick insights into market sentiment and trends. Its sentiment analysis feature helps investors gauge how news and social media could impact market behavior.

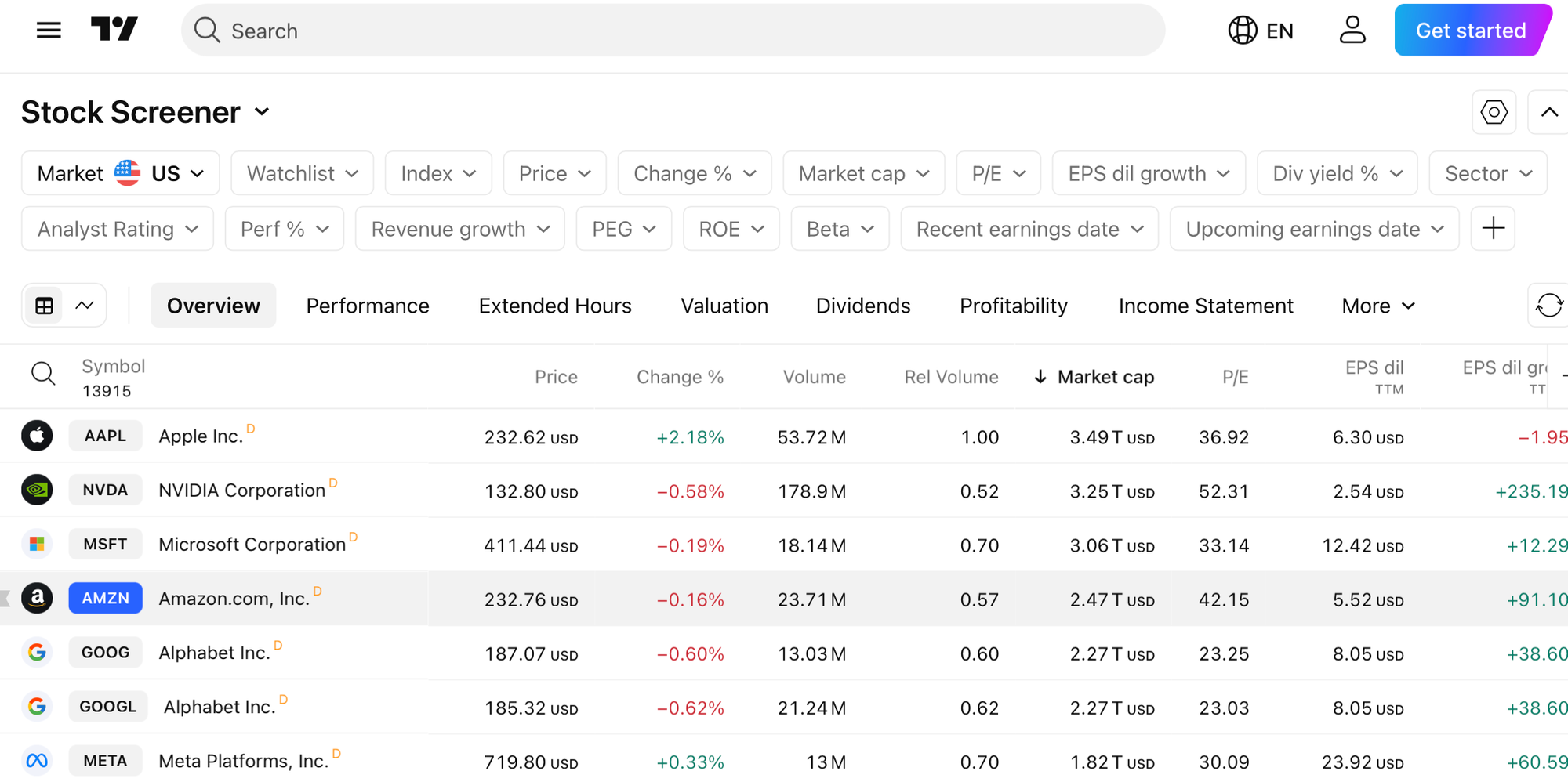

TradingView: Charting and Sentiment Analysis

TradingView allows retail investors to visualize stock price movements and analyze market patterns using technical indicators. TradingView also features a social aspect, allowing users to share market insights and predictions.

The Rise of Other Retail Investing Platforms

In recent years, retail investors have gained access to a variety of user-friendly platforms that make investing more accessible. Platforms like Robinhood, Webull, and Acorns have reduced the barriers to entry by offering low fees and intuitive interfaces.

These platforms have democratized investing by allowing more people to trade stocks, ETFs, and cryptocurrencies with ease. However, the ease of access has also led to impulsive trading decisions, especially during times of market volatility. Retail investors may act based on social media trends or market sentiment rather than solid financial analysis, leading to emotional trading behavior.

How Institutional Investors Leverage Their Tools

Institutional investors use specialized platforms that provide deeper insights into financial markets and enhanced execution capabilities. Their tools enable them to process large amounts of data and make more precise decisions.

- Bloomberg Terminal: A premium tool that offers real-time financial data, analytics, and proprietary research. This platform is used by institutional investors to access in-depth market analysis, trading opportunities, and economic news.

- FactSet: Provides financial modeling, portfolio analytics, and market intelligence. It allows institutions to track economic trends and analyze company performance in real time.

- QuantConnect & Alpha Vantage: Platforms that offer algorithmic trading tools and machine learning capabilities. These allow institutions to build custom models and strategies based on vast datasets.

- Alternative Data Providers: Companies like Quandl and YipitData offer institutional investors access to unconventional data sources, such as satellite imagery and consumer behavior patterns, to enhance their investment analysis.

- High-Frequency Trading (HFT): Institutions often use HFT systems to execute trades within milliseconds. These systems are designed for ultra-fast trading and are essential for institutional investors to stay competitive in today's market.

Key Differences in How They Use Investment Platforms

| Feature | Retail Investors | Institutional Investors |

|---|---|---|

| Capital Size | Small to medium | Large |

| Investment Horizon | Short to medium | Long-term and short-term |

| Decision-Making | Individual-based | Team-based, data-driven |

| Access to Data | Publicly available | Proprietary and private data sources |

| Trading Frequency | Varies, often lower | High-frequency, algorithmic |

| Regulatory Constraints | Fewer regulations | Subject to strict compliance |

Future Outlook: How Investing Is Changing

The gap between retail and institutional investors is narrowing, driven by advancements in technology, increased market transparency, and shifting investor psychology. The future of investing will be shaped by artificial intelligence, social sentiment, and a growing emphasis on responsible investing.

1. AI and Machine Learning: Reducing Emotional Bias in Investing

Artificial intelligence is revolutionizing investment strategies by addressing the emotional biases that often influence decision-making. Both retail and institutional investors experience cognitive biases—fear, greed, overconfidence, and loss aversion—that can lead to poor investment choices. AI and machine learning are mitigating these issues in several ways:

- Retail Investors: AI-powered platforms like StockNews.AI help individuals make data-driven investment decisions by analyzing vast amounts of financial data, market trends, and sentiment signals. Unlike human investors, AI models do not experience emotional biases. This reduces the tendency for retail investors to overreact to short-term market movements.

- Institutional Investors: Hedge funds and asset managers employ machine learning algorithms to identify trading opportunities, optimize portfolio allocations, and automate high-frequency trading. AI-driven decision-making minimizes the impact of psychological distortions that typically arise from human intuition.

As AI continues to evolve, its role in investment strategy will expand. Future AI systems will not only provide recommendations but also execute trades autonomously, refining strategies based on real-time feedback. This will help level the playing field between retail and institutional investors, offering retail participants institutional-grade insights.

2. The Rise of Social Investing: Psychology Meets Technology

Social media platforms like Reddit, Twitter, and Discord are amplifying market psychology, allowing retail investors to coordinate and challenge traditional market structures. The influence of herd behavior in investing has become more apparent in recent years, as seen in the GameStop and AMC short squeezes.

- Herd Mentality: Investors often follow the crowd rather than conducting independent research, leading to inflated stock prices based on hype rather than fundamentals. This can create unsustainable bubbles.

- Fear of Missing Out (FOMO): Rapid price surges trigger panic-buying among retail investors who fear being left out of potential gains. However, buying into a peak can lead to significant losses when the hype fades.

- Panic Selling: Just as FOMO drives excessive optimism, panic selling results from excessive pessimism. When negative sentiment spreads, investors may exit positions prematurely, even if the long-term fundamentals remain strong.

Institutional investors are now incorporating sentiment analysis into their trading strategies, tracking social media trends to anticipate retail-driven movements. Some hedge funds have even developed algorithms that monitor Reddit discussions and Twitter activity to predict retail trading behavior before it impacts stock prices. This dynamic underscores how market psychology is being quantified and integrated into investment strategies.

3. Market Transparency and Regulatory Shifts

With the surge in retail trading, regulators are stepping in to ensure a fair market environment. The future of investing will likely include increased oversight of:

- Social Media-Driven Stock Movements: Regulatory bodies such as the SEC are monitoring how social sentiment influences stock prices, aiming to prevent coordinated pump-and-dump schemes that manipulate markets.

- High-Frequency and Algorithmic Trading: Institutions using algorithmic trading models have a significant speed advantage over retail traders. Regulatory changes may impose greater oversight on these systems to prevent unfair market manipulation.

- Retail Investor Protections: Given the rise of commission-free trading and fractional shares, regulators may impose stricter rules on brokerage platforms to ensure transparency in order execution, margin lending, and risk disclosures.

As regulators attempt to balance market accessibility with fairness, retail investors must stay informed about evolving policies that may impact their trading strategies. Increased transparency will foster greater trust in financial markets, ensuring that both institutional and retail investors operate on a level playing field.

4. Sustainable and Ethical Investing (ESG): Aligning Values with Strategy

Investor psychology is also shifting toward long-term sustainability and ethical considerations. Environmental, Social, and Governance (ESG) investing has become a central theme for both institutional and retail investors.

- Retail Investors: More individuals are choosing investments that align with their personal values, prioritizing companies with strong ESG practices. This is particularly true among younger investors who view sustainability as a key component of long-term financial success.

- Institutional Investors: ESG factors are becoming integral to risk assessment and investment strategy. Companies with high ESG scores tend to demonstrate better corporate governance, reduced regulatory risk, and stronger long-term profitability.

As this trend continues, companies failing to meet ESG standards may struggle to attract investors, while those that prioritize sustainability will likely see increased capital inflows. This psychological shift signifies a move away from short-term speculation toward long-term, responsible investing.

Conclusion

The future of investing is shaped by a dynamic interplay between technology, psychology, and regulation. While institutional investors still have advantages in data and capital, retail investors are gaining ground through AI-powered insights, social investing, and increased market transparency.

Understanding market psychology—from emotional biases to herd behavior—will be critical for both groups to navigate an evolving financial landscape. As data-driven decision-making continues to rise, the balance of power in the investing world will shift, creating new opportunities for investors who can separate sentiment from strategy.