Sentiment in the Stock Market -- Best 5 Sentiment Analysis Tools in 2025

"The stock market is driven by two powerful emotions—fear and greed."

Introduction

Market sentiment is one of the most powerful forces in the stock market. It reflects the collective emotions, attitudes, and expectations of investors toward financial markets and individual stocks. Understanding market sentiment is crucial for making informed investment decisions, as it can drive stock prices up or down even when fundamentals remain unchanged. Whether you're an experienced investor or a beginner, grasping market sentiment can give you an edge in navigating the complexities of stock trading. This article explores the role of sentiment in the market, factors influencing it, ways to measure it, and tools that can help track investor psychology for smarter investment decisions.

Understanding Market Sentiment and Its Influences

Market sentiment is essentially the "mood" of investors. It dictates whether people are feeling optimistic (bullish) or pessimistic (bearish) about the market. When sentiment is positive, stock prices tend to rise because more investors are buying. Conversely, when sentiment is negative, stocks often decline as investors sell off their holdings. But why is understanding sentiment so important? And how does it differentiate knowledgeable investors from those merely reacting emotionally?

Short-Term vs. Long-Term Sentiment

Market sentiment differs depending on the time horizon, with short-term and long-term sentiment shaped by different factors.

- Short-Term Sentiment: This is often influenced by news, social media, and macroeconomic events, causing sharp fluctuations in stock prices. Short-term sentiment indicators such as the Fear & Greed Index or the VIX (Volatility Index) can give traders insights into market psychology for more tactical decision-making. For example, sentiment can quickly turn negative in response to geopolitical tensions or economic data releases, prompting short-term sell-offs or rallies. Short-term sentiment is often characterized by high volatility and emotional reactions to current events.

- Long-Term Sentiment: This is driven by broader factors, including economic cycles, corporate growth, and geopolitical stability. Long-term investors typically focus on the underlying strength of companies and industries, adjusting their portfolios based on economic trends and long-term sentiment shifts. For instance, long-term optimism regarding technology or renewable energy might drive persistent bullish sentiment over years, despite short-term volatility. Long-term sentiment reflects deeper trends such as technological advancements, demographic changes, and global economic growth, and tends to be less volatile than short-term sentiment.

The difference between short-term and long-term sentiment is crucial when deciding how to position your investments. Short-term sentiment may offer trading opportunities, but long-term sentiment plays a larger role in wealth-building strategies, particularly for buy-and-hold investors.

Why Is It Important to Understand Market Sentiment?

Investors often react not only to data but also to emotions like fear, greed, and uncertainty, which can lead to rapid price changes even when company fundamentals are strong or weak. A market move driven by sentiment rather than logic is a classic example of market irrationality. In such environments, understanding sentiment can help investors make better decisions by recognizing whether market movements are likely to be short-term blips or signs of long-term trends.

- Predicting Market Trends: Recognizing shifting sentiment before it becomes widespread allows investors to position their investments ahead of market movements. For instance, during the COVID-19 pandemic, those who noticed fear-driven sentiment early on could have shorted stocks before the market collapsed. Sentiment often precedes fundamental shifts, making it a valuable tool for forecasting.

- Avoiding Emotional Investing: Many investors are prone to buying when prices are high and panic-selling when prices drop. Sentiment analysis allows you to act rationally, steering clear of decisions driven by fear or overconfidence. Understanding sentiment can help you resist the temptation to chase trends or sell at a loss during periods of pessimism.

- Capitalizing on Opportunities: When sentiment turns negative, it can create opportunities to purchase undervalued stocks that may have strong fundamentals but are temporarily beaten down by broad market fear. For instance, during market corrections, stocks of fundamentally strong companies often drop along with the overall market, providing potential buying opportunities for savvy investors.

What Sets You Apart If You Understand Market Sentiment?

If you grasp market sentiment, you have a competitive advantage. Here’s how:

- You Don’t Follow the Herd: Instead of blindly following trends, you recognize when emotions are driving prices and make strategic decisions accordingly. This allows you to take positions that are contrary to the prevailing sentiment when the crowd is overly optimistic or fearful.

- You Time the Market More Effectively: Understanding sentiment trends allows you to act more proactively. Recognizing when investor optimism or pessimism reaches extremes can signal the best entry or exit points for stocks.

- You Manage Risk Better: Knowing when the market is in a state of uncertainty can help investors avoid risky investments or excessive exposure during volatile periods. Understanding sentiment helps investors gauge when it's safer to sit on the sidelines or take a contrarian position.

Top Factors Influencing Market Sentiment

Several factors shape market sentiment, but some have a stronger influence than others. These elements dictate whether investors feel confident or fearful, and their impact varies depending on market conditions. Below are the top-ranked factors affecting sentiment and how they create market-wide reactions.

- News & Media Coverage

The financial news has an immediate impact on sentiment. For instance, an unexpected interest rate hike by the Federal Reserve can cause a sharp decline in stocks, while positive earnings reports from major companies can boost investor confidence. Social media platforms, financial news networks, and influencers also play a major role in shaping public perception. - Federal Reserve Policies & Interest Rates

When interest rates rise, borrowing becomes more expensive, reducing consumer spending and corporate growth, which can lead to bearish sentiment. Conversely, when interest rates are lowered, cheap credit fuels investments, leading to bullish market sentiment. - Macroeconomic Indicators (Inflation, GDP, Employment Data)

A strong jobs report signals economic strength, boosting investor confidence. High inflation erodes purchasing power, leading to pessimistic sentiment and possible market sell-offs. - Corporate Performance & Earnings Reports

If a company reports strong earnings, sentiment turns positive, and stock prices tend to rise. Conversely, missed earnings expectations can spark fear, leading to sell-offs. - Social Media & Retail Investor Influence

Platforms like Reddit’s WallStreetBets and Twitter can drive stock prices independent of fundamentals. Meme stock rallies, such as GameStop and AMC, are clear examples of sentiment-driven investing.

Investor Psychology and Behavioral Biases

Investor sentiment is often driven by cognitive biases, which shape how individuals perceive and react to market movements. These biases can lead to irrational decisions, amplifying market trends and creating bubbles or crashes. Some of the most common biases influencing market sentiment include:

- Herd Mentality: Investors often follow the crowd, especially during periods of market euphoria or panic. This herd mentality can lead to inflated stock prices when the market is overly optimistic or excessive sell-offs during downturns, leading to irrational price swings.

- Confirmation Bias: Traders and investors tend to seek information that confirms their existing views while dismissing or undervaluing contradicting data. This bias leads to a reinforcing loop of sentiment, where investors continue to act based on their preconceptions, even in the face of contrary evidence.

- Overconfidence: Overconfident investors believe they have a superior understanding of the market and often make riskier decisions. This bias is particularly evident in market rallies, where investors believe their predictions are infallible, leading them to take on more risk than they should. Overconfidence can also result in holding onto losing positions too long, hoping that sentiment will shift in their favor.

Recognizing and mitigating these biases can help investors remain objective and grounded in their decision-making, thus enhancing their ability to take advantage of market opportunities rather than being swayed by emotional impulses.

How Does Market Sentiment Affect Stock Analysis?

Market sentiment significantly influences both fundamental and technical analysis. Investors must recognize how sentiment can impact stock movements, even when financial data suggests otherwise.

- Fundamental Analysis: Even strong companies can struggle when sentiment is negative. For example, Amazon saw a stock decline during market-wide bearish sentiment despite strong earnings.

- Technical Analysis: Traders use moving averages, momentum indicators, and volume trends to gauge sentiment-driven price movements.

- Real-World Example: Tesla’s stock frequently reacts to Elon Musk’s tweets, highlighting how sentiment can outweigh financial fundamentals.

How to Measure Market Sentiment?

Market sentiment isn’t something you can see directly, but there are various tools and indicators that help gauge investor emotions. Understanding these indicators can help investors make better trading decisions.

Easy Ways to Understand Market Sentiment

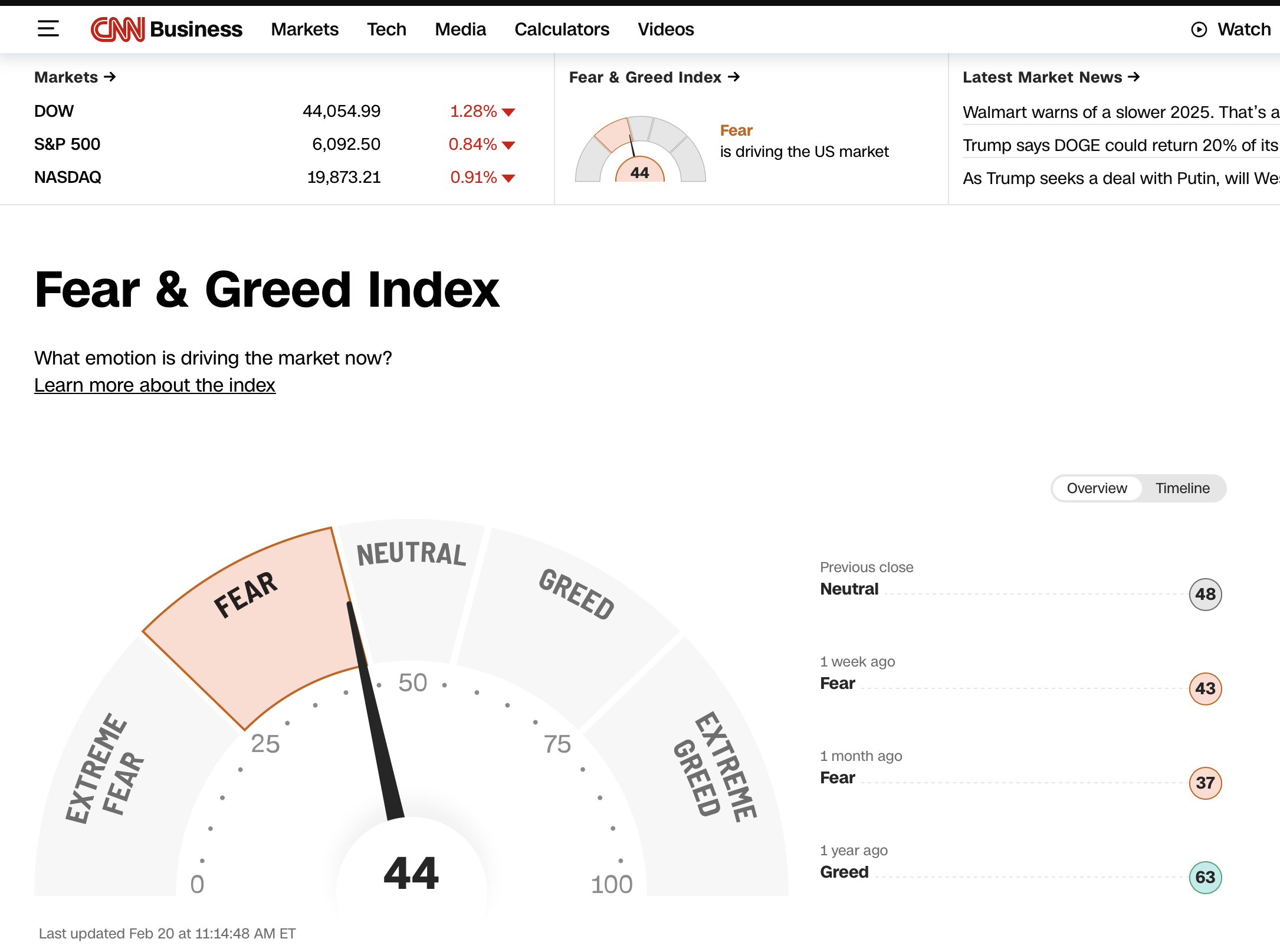

- Fear vs. Greed Index: Shows whether investors are overly optimistic (greedy) or pessimistic (fearful). High greed signals overconfidence, while extreme fear often indicates buying opportunities.

- VIX (Volatility Index): Also called the "fear gauge," it measures expected market volatility. A rising VIX suggests growing uncertainty.

- Put/Call Ratio: Tracks the ratio of bearish to bullish options trades. Higher put activity signals fear, while higher call activity indicates confidence.

- Social Media Sentiment Trackers: AI-based tools analyze discussions on Twitter, Reddit, and forums to determine investor mood.

- Surveys & Investor Polls: Periodic polls measure whether investors feel optimistic or pessimistic about market conditions.

Top 5 Sentiment Tracking Tools

Investors don’t need to rely on gut feelings to assess market sentiment — several tools help track investor psychology. These platforms provide real-time insights that can be used to refine trading strategies.

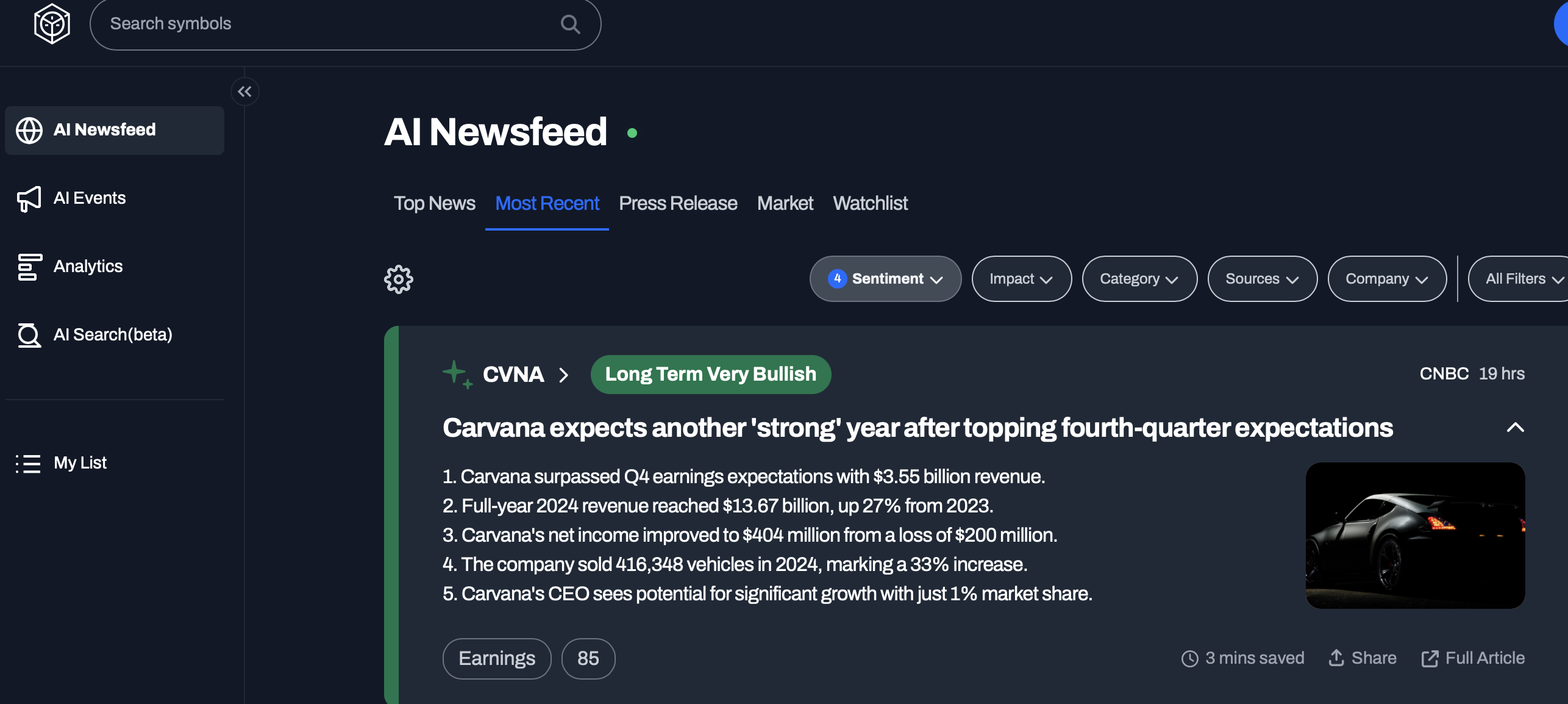

StockNews.AI is an advanced AI-driven tool designed to help investors track market sentiment through data analysis. The platform gathers information from financial reports, news articles, and social media to generate insights into investor psychology. By leveraging machine learning, StockNews.AI provides users with real-time sentiment scores for stocks and the overall market.

Key features include:

- Real-time AI-driven market sentiment analysis.

- Machine learning insights for trend predictions.

- Comprehensive financial news aggregation.

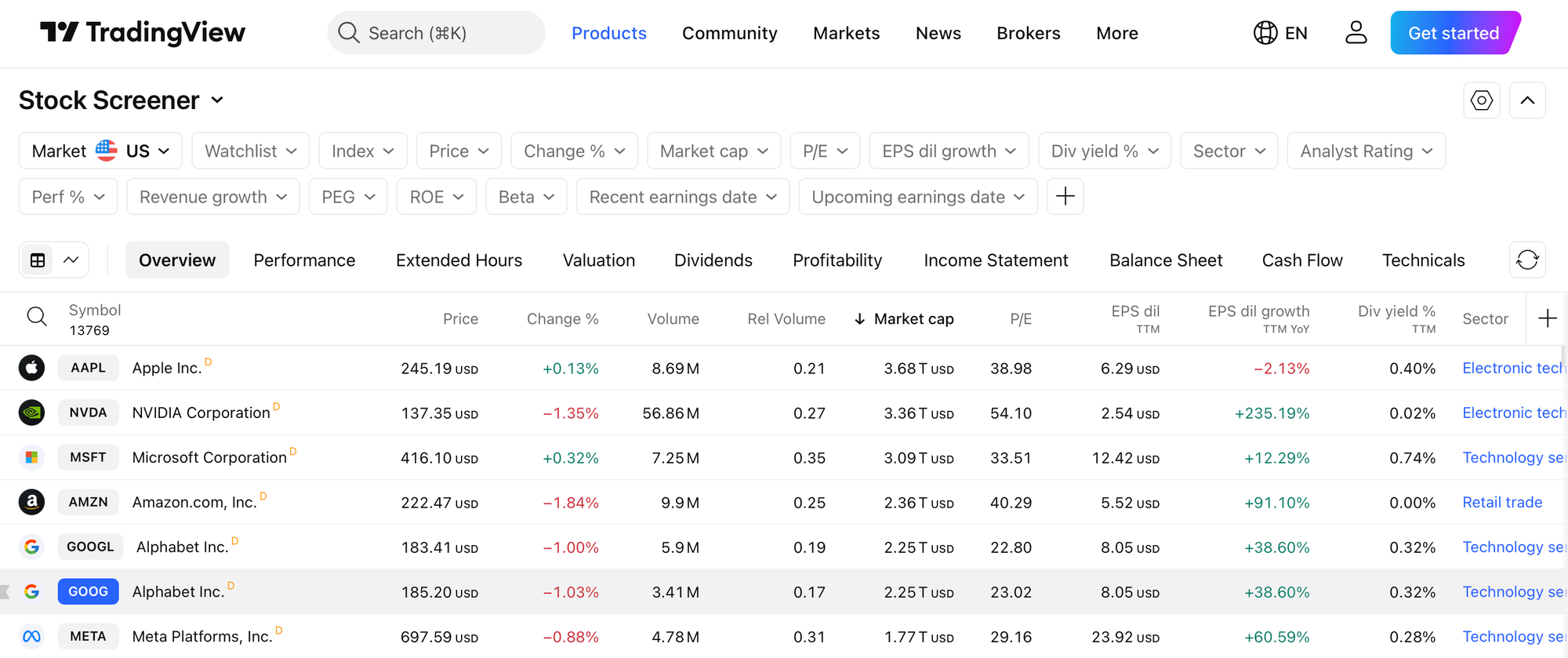

TradingView is a popular platform among both beginner and advanced traders. It provides powerful charting tools, social sentiment indicators, and investor discussions. Users can analyze technical indicators while also gauging market sentiment based on trending discussions and user-generated content.

Key features include:

- Customizable technical analysis tools.

- Social sentiment tracking from investor discussions.

- Interactive market data visualization.

The CNN Fear & Greed Index is a simple yet effective tool that measures investor sentiment on a scale from extreme fear to extreme greed. It aggregates multiple market indicators to provide a broad overview of current market psychology, making it particularly useful for beginners.

Key features include:

- Beginner-friendly interface.

- Tracks multiple sentiment indicators.

- Updated daily for market trend insights.

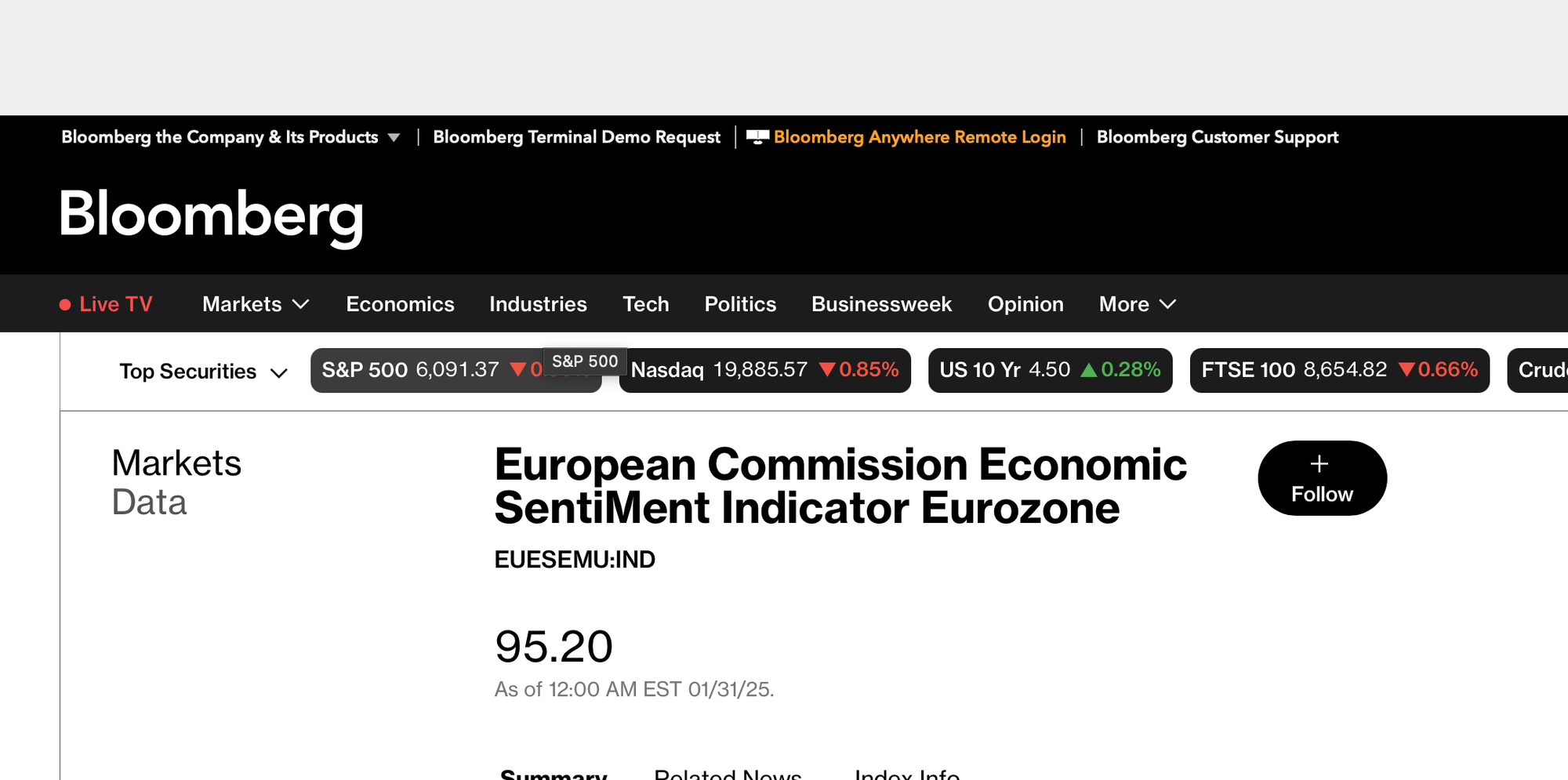

Bloomberg provides sophisticated sentiment tracking tools tailored for professional investors. It aggregates institutional data, news sentiment, and financial reports to offer a well-rounded view of market conditions.

Key features include:

- High accuracy in sentiment tracking.

- Widely trusted by institutional investors.

- Real-time data from professional sources.

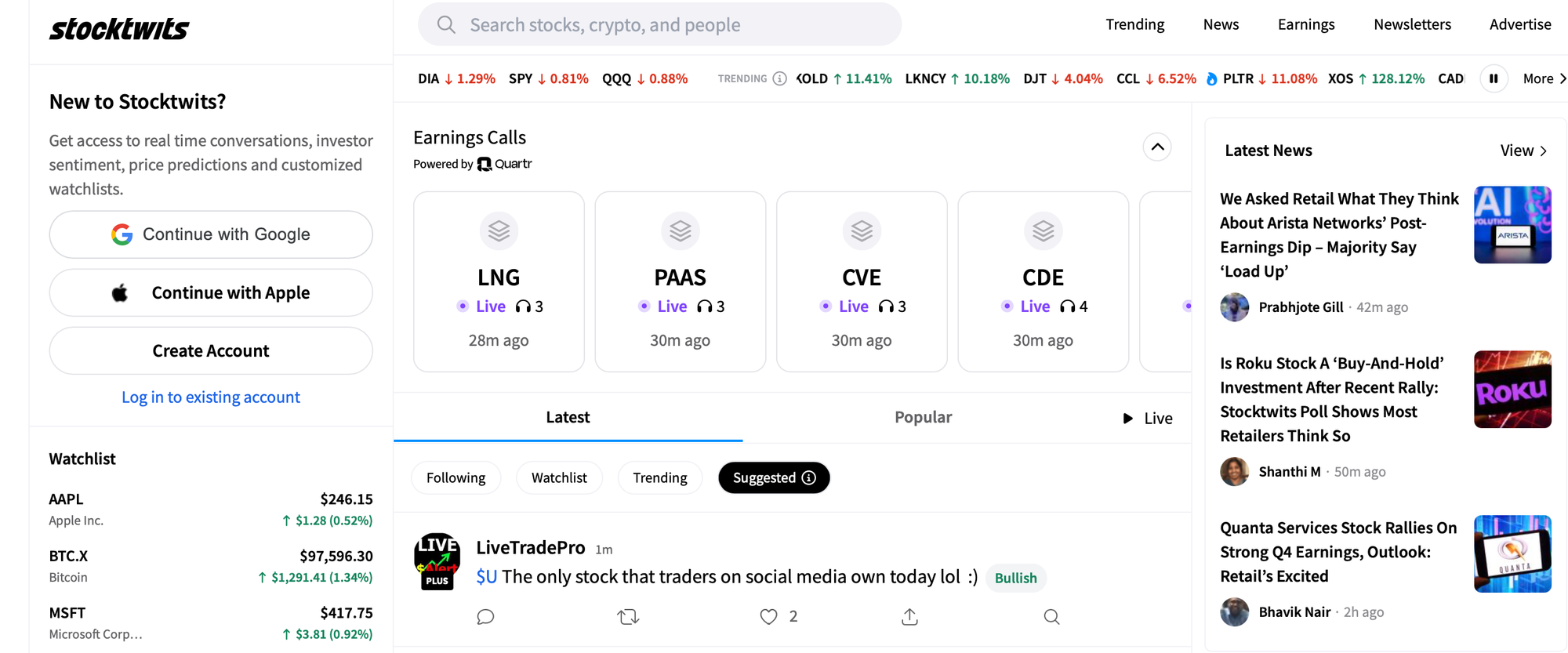

StockTwits is a social platform dedicated to stock market discussions. It allows traders to share opinions, track trending stocks, and gauge sentiment from a wide community of retail investors.

Key features include:

- Easy access to trending stocks and investor sentiment.

- Community-driven discussions.

- Real-time market insights.

| Tool | Key Features | Best For | Sentiment Type |

|---|---|---|---|

| StockNews.AI | AI-driven analysis, real-time sentiment | Advanced investors | Both Short & Long-term |

| TradingView | Technical analysis, social sentiment | Traders | Short-term |

| CNN Fear & Greed Index | Tracks sentiment indicators | Beginners | Short-term |

| Bloomberg | Institutional data, news sentiment | Professional investors | Both Short & Long-term |

| StockTwits | Trending stocks, social insights | Retail investors | Short-term |

Conclusion

Market sentiment is not just a fleeting factor in investment decisions—it's a driving force that shapes market movements and investor outcomes. By mastering the psychology behind sentiment and leveraging the right tracking tools, investors gain a critical edge in predicting market trends, minimizing risks, and capitalizing on opportunities that others might overlook. Whether harnessing advanced AI-powered analytics or utilizing time-tested indicators like the Fear & Greed Index, integrating sentiment analysis into your investment strategy is a game changer. In the ever-shifting landscape of the stock market, those who understand and adapt to investor psychology will not only survive but thrive, turning insights into lasting financial success.