The New Era: AI Agents Will Redefine Financial Strategy

Financial professionals are often stifled by inefficiencies. They wasted time on repetitive tasks such as handling Excel instead of actual analysis. This inefficiency hinders decision-making, stifles innovation, and erodes competitive advantage.

“The last analyst who types will lose. The first analyst who delegates to AI will lead.”

Introduction: The Cost of Typing Over Thinking

Step into any modern financial team — whether an investment bank, hedge fund, or asset management office — and you’ll witness a paradox: brilliance trapped in bureaucracy. Analysts, associates, and even portfolio managers spend the majority of their workdays in spreadsheets, PDF filings, earnings call transcripts, and endless slide decks. Meetings, compliance updates, and report formatting consume hours that could otherwise be spent analyzing strategy, markets, and opportunities.

For decades, this inefficiency has been the accepted norm. It’s a silent drag on alpha generation, on career growth, and on competitive advantage. Market intelligence and strategic insights move at the speed of thought, yet the workflow of financial professionals often lags far behind.

Enter the AI Agent — a technological evolution poised to flip this equation. Unlike basic chatbots or data aggregators, AI Agents combine autonomous reasoning, financial logic, and actionable output, enabling financial professionals to redirect their energy from repetitive tasks to high-value strategy. In the next decade, those who adopt AI Agents will lead, while those who resist will fall behind.

I. AI Agents — Definition, Origins, and Why Finance Is Ground Zero

(i). Defining the AI Agent

According to the definition (Google Cloud, https://cloud.google.com/discover/what-are-ai-agents), AI agents are software systems that "use AI to pursue goals and complete tasks on behalf of users." They show "a level of autonomy to make decisions, learn, and adapt."

At its core, an AI Agent is more than a tool — it is a virtual financial assistant with reasoning capabilities. Unlike standard AI chatbots, AI Agents have four defining characteristics:

- Context Awareness: They remember prior tasks, relevant datasets, and the nuances of the financial domain.

- Autonomous Reasoning: They can interpret trends, highlight anomalies, and propose actionable insights.

- Workflow Integration: They output information in professional formats, from Excel tables to detailed reports.

- Proactive Action: They don’t just respond; they monitor, alert, and suggest actions in real time.

Put simply, an AI Agent is an assistant that can read, understand, analyze, and act — all while freeing human professionals from mundane work. Unlike a chatbot, an AI Agent has context, memory, workflow, and a mission, not just a conversation.

(ii). Where did AI Agents come from?

AI Agents didn't come out randomly and suddenly; years ago, we've started to see technological evolutions yet realize they're steps into what we're used to in today's world. For example, Apple first announced Siri's debut in 2010, a mainstream voice assistant with natural language capabilities. Then in 2014, Amazon launched Alexa, a virtual assistant implemented in software applications for mobile devices. However, it's until recent years that we started to see the mature models like ChatGPT and embed them into lives. Below are the simplified timeline about the evolution:

- 2017: Introduction of Transformer architectures, the backbone of modern large language models (LLMs).

- 2018–2022: Scaling of foundation models (BERT, GPT-3, PaLM) that demonstrated comprehension and reasoning at near-human levels.

- 2023: ChatGPT popularizes conversational AI, proving the utility of LLMs in real-world problem-solving.

- 2024–2025: Emergence of agent-based AI — systems capable of autonomous reasoning, continuous learning, and workflow execution.

This evolution represents a shift from searching for answers to generating actionable intelligence.

Search → ChatGPT → AI Agent

(Answering → Reasoning → Acting)

(iii). Why finance is the perfect industry for AI Agents

A lot of industries are benefited from AI and probably cannot live without it in the future. Especially in finance, AI has become a part of life, as we can see all the major financial institutions begin their competition in the AI investment and execution. But why finance?

Finance, by its nature, is a data-rich, time-sensitive, and analysis-heavy industry — making it the perfect ground zero for AI Agents.

| Finance Attribute | Why AI Agents Excel |

|---|---|

| Data-rich | Agents can ingest and process at superhuman speed |

| Repetitive | Reports, filings, monitoring = automatable |

| Time-sensitive | Faster insight = competitive edge |

| Interpretation-heavy | Perfect for LLM reasoning & summarization |

With AI agent's support, analysts can spend less time being typists and more time being strategists.

II. How AI Agents Help: Professionals vs. Investors

(i). Financial Professionals: Turning Hours into Strategy

Numerous surveys and interviews have shown that analysts on average, spend half of their work day just to digest information and find insights from overwhelming amount of data. Therefore, the adoption of AI Agents is transformational. They eliminate repetitive and time-consuming tasks, allowing humans to focus on high-leverage work.

Below are the key areas where AI Agents save time and enhance capability:

- Data Collection & Cleaning: Agents pull filings, historical price data, and transcripts automatically.

- Market & Portfolio Monitoring: Real-time alerts based on investment theses.

- Report Generation: Drafts executive summaries, full research reports, or client-ready decks in minutes.

- Trend Analysis: Identify long-term patterns, anomalies, and key performance drivers.

- Scenario Modeling: Stress-test portfolios or valuations with minimal manual effort.

The workflow can also be improved.

Before: Analysts spend hours manually collecting, formatting, and summarizing. Only a fraction of time remains for interpretation.

After: Agents handle the grunt work, delivering structured insights. Analysts spend more time questioning assumptions, debating strategy, and identifying alpha opportunities.

The result is a redefinition of professional roles: from operational execution to strategic insight.

(ii). For Investors: Faster Decisions, Broader Horizons

Investors, whether in venture capital, hedge funds, or family offices, also benefit:

- Rapid Conviction: AI Agents synthesize market trends and company performance instantly.

- Expanded Universe Coverage: Evaluate opportunities across geographies, sectors, and asset classes without additional human resources.

- Bias Reduction: Agents present data and analysis without emotional or cognitive bias.

- Scenario Planning: Rapid testing of investment hypotheses across multiple assumptions.

In essence, AI Agents compress the time from data to decision, enabling investors to act decisively and consistently. Investors can evolve from information gatherers → decision architects.

III. Real-World Use Cases in Financial Workflows

(i). Individual Stock Analysis

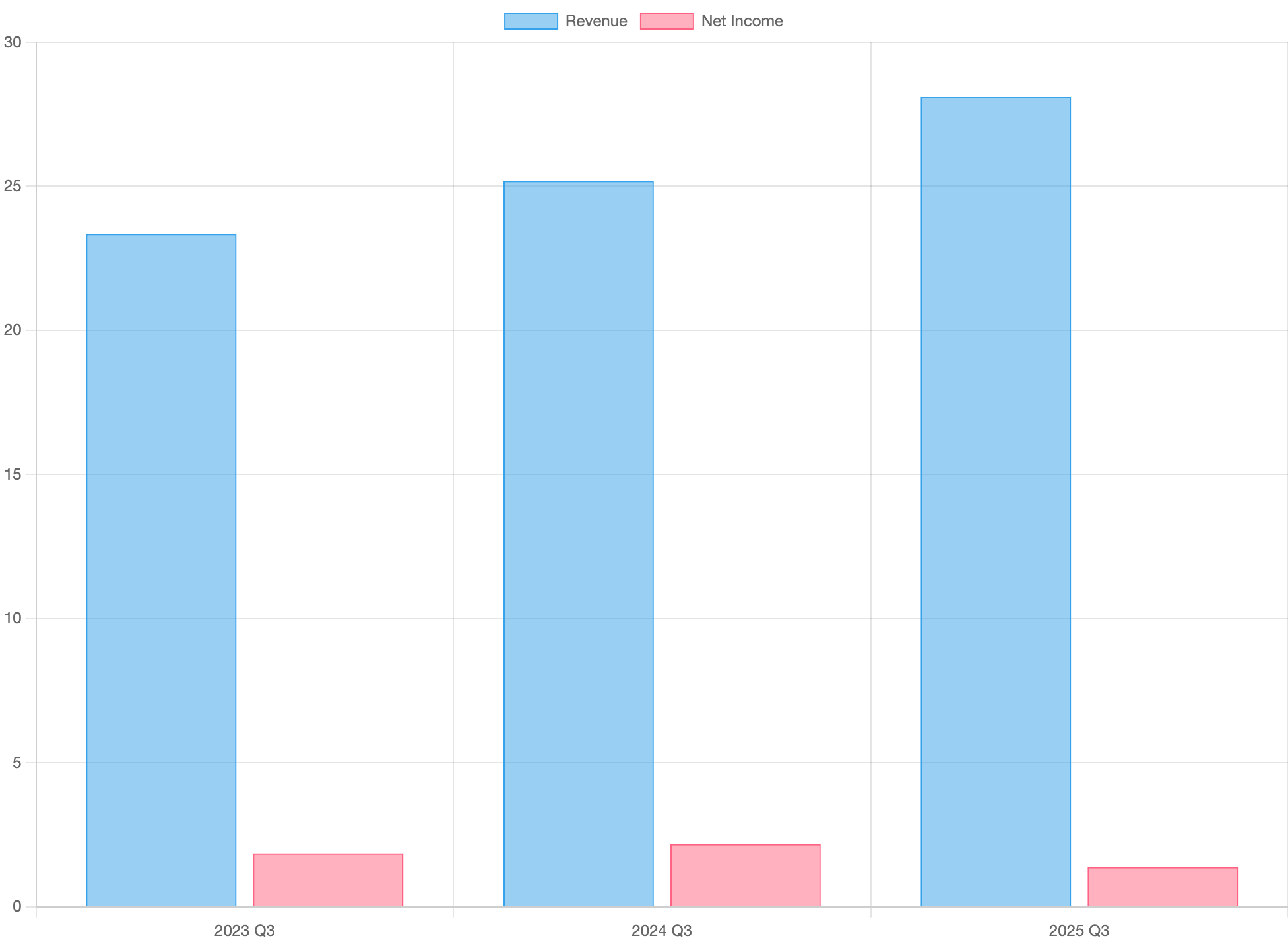

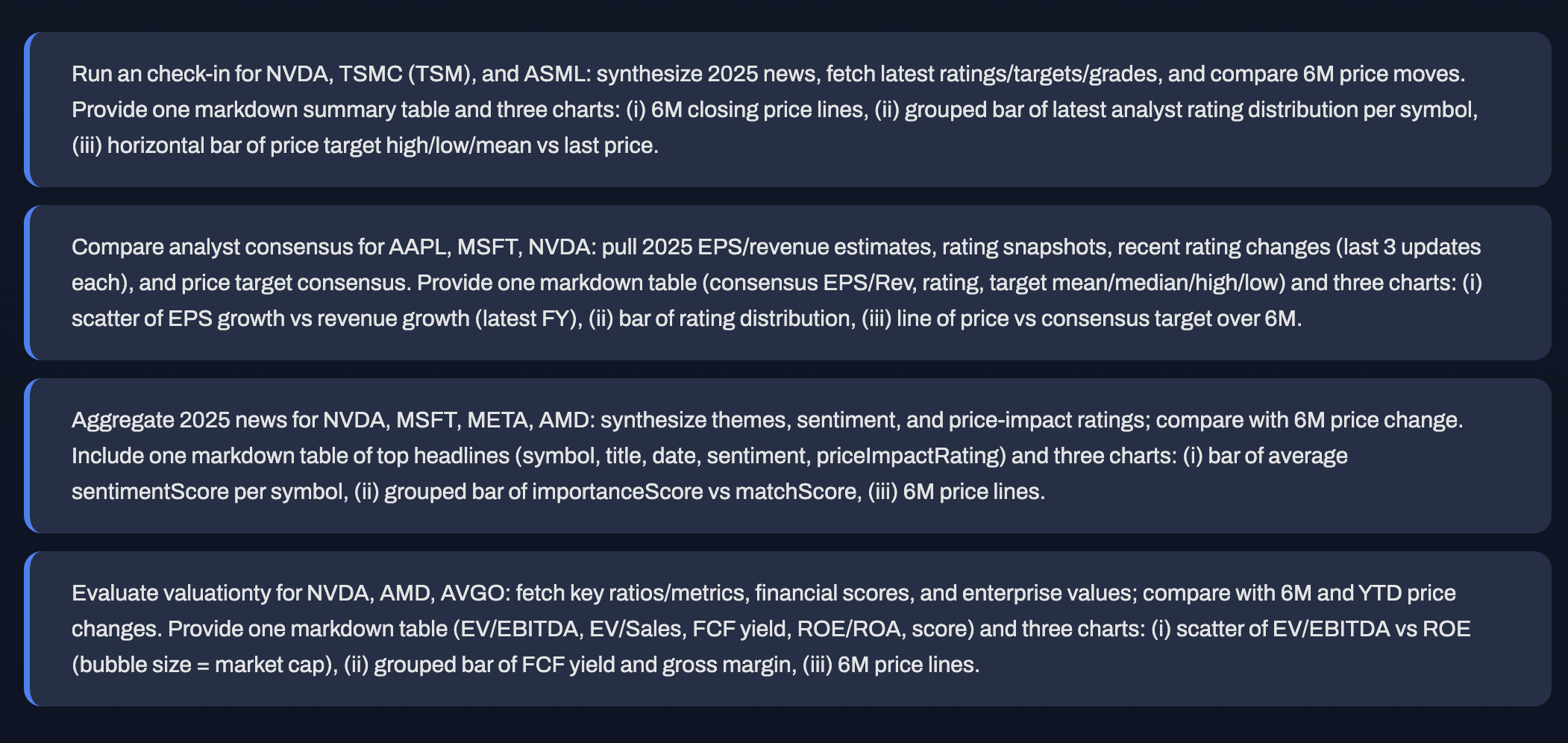

In the past, financial professionals had to go over thousands of platform and websites to get thorough information before beginning their stock analysis. With AI Agent's help, analysts can extract and analyze a company’s historical data over a decade in minutes:

- Revenue & EBITDA Trends: Identify structural growth patterns.

- Margin Evolution: Detect efficiency improvements or declines.

- Peer Benchmarking: Compare performance across competitors.

- Event Correlation: Link earnings surprises, regulatory changes, or macro shifts to stock movements.

Analysis is no longer a pain. By automating these tasks, analysts gain strategic time to interpret findings and test forward-looking hypotheses. With correct keywords, results are available in a few seconds.

- Input: Price history, 10-K, 10-Q, transcripts, news

- Process: Screening → KPI extraction → Trend logic → Peer benchmarking

- Output: Insight summary, charts, bullet conclusions

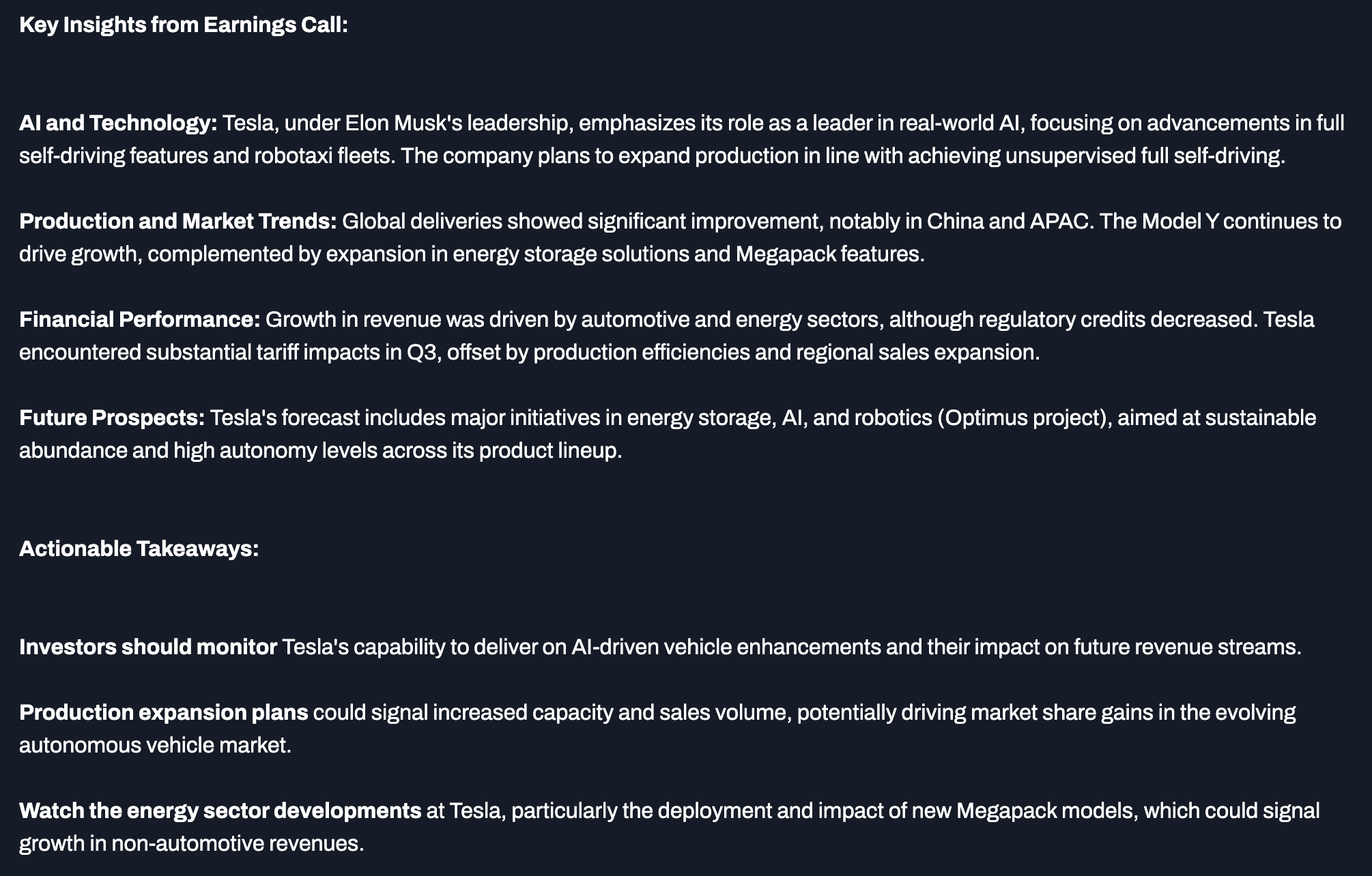

Using StockNews.AI's AI Agent for Earning Report Analysis.

Instead of producing a spreadsheet and asking the VP, “What do you think?”, the agent produces a view — and a recommendation — for the analyst to refine. The analyst now argues strategy instead of cell formulas.

(ii). Customized Reports — 1 Pager or Full Deep Dive

No matter it's a full analysis or a high-level report, AI Agents produce tailored reports for different audiences:

- Morning Briefs (1 Pager): Quick digest of overnight events and portfolio impacts.

- Internal Memos (2–3 Pages): Focused insights for team meetings or investment committees.

- Full Research Reports (15–25 Pages): Comprehensive analysis for clients or strategic planning.

Again, reporting is no longer a pain. Analysts no longer spend hours formatting; their expertise is applied where it matters most — interpretation and strategy. No strategic time is wasted by using the correct keywords to get what analysts need in just a few seconds.

- Input: Topic, data sources, template preference

- Process: Draft → Fact-check → Style → Output

- Output: Formatted report aligned to audience requirements

This solves a massive pain:

Every firm has brilliant insights, but formatting and writing slow them down.

With an AI Agent, the analyst’s thinking becomes faster to distribute and more likely to be read.

(iii). Daily / Weekly Market Intelligence

Instead of reading 40 articles to find 2 insights, an AI Agent delivers:

- Market summary

- Key movers

- Sector impacts

- Macro cross-currents

- Risk flags

- Actionable angles

Not trying to repeat myself again, but the truth is: bureaucratic work is no longer an issue. AI agents just save a huge amount of labor time from formatting, wording, researching, etc.

- Input: Global news, macro data, earnings, alerts

- Process: Filter → Cluster → Rank → Interpret

- Output: Daily digest, weekly outlook, or sector brief

Using StockNews.AI's AI Agent for Daily Report (e.g., market overview)

Professionals can finally stop drowning in information and start reading only what matters.

(iii). Additional Expandable Use Cases

AI agent is helpful not only in reporting, but also other fields of expertise. See the examples below.

| Category | AI Agent Value |

|---|---|

| Risk Management | Scenario modeling and stress-test narratives |

| Valuation Work | DCF checkpoints, sensitivity tables, comparables |

| Portfolio Monitoring | Alerts tied to thesis, not just price |

| Screening & Idea Gen | Multi-factor screens and theme discovery |

| Compliance Support | Draft logs, summaries, and documentation |

Without a doubt, AI agent becomes not just the best tool for analysts but their second brain for strategic thinking and decision-makings.

IV. How to Use AI Agents as Partners, Not Rivals

The winners in AI-finance will be the professionals who understand a simple truth:

AI will not replace analysts. Analysts who use AI will replace analysts who don’t.

To make the AI Agent your teammate instead of your threat:

Step 1 — Offload the “90% Work That Creates 10% Value”

- Data extraction, writing drafts, monitoring, and summarizing

Step 2 — Spend Your Time on Interpretation and Strategy

- Investment logic

- Differentiated insight

- Forward-looking narrative

- Human judgment and accountability

Step 3 — Treat the AI Agent as a Junior Analyst You Manage

- Give clear instructions

- Review output

- Ask “why?” and stress-test its logic

Step 4 — Build Repeatable AI Workflows

- Standardize prompts

- Standardize templates

- Standardize monitoring rules

This is how a professional 10x’s their output without burning out.

V. Conclusion: The Future of Financial Work

For 40 years, Microsoft Excel defined finance. For the next 40, AI Agents will.

Teams that adopt agents early will:

- Make faster, better-informed decisions

- Operate leaner while producing more insight

- Focus on strategy, not paperwork

Professionals who embrace AI Agents will rise faster, outperform peers, and spend their careers thinking instead of typing. The future of finance is clear: insight over bureaucracy, strategy over execution, and humans working in partnership with AI to redefine what’s possible.

The choice is here now.