Employees Looking for More Employer Resources on Financial Wellness, Emergency Savings and Debt

CHARLOTTE, N.C., Sept. 3, 2025 /PRNewswire/ -- While nearly 7 in 10 employees (68%) remain optimistic about their financial future over the next three years, many are seeking advice around both long-term savings and managing their personal finances today. This, combined with higher living costs and persistent inflation, is causing more workers to look for help prioritizing all their financial needs at once.

Twice as many American workers today are looking to their employers for guidance and resources around near-term financial needs, compared to two years ago. According to Bank of America's 2025 Workplace Benefits Report (PDF), conducted in partnership with Bank of America Institute, 26% of the workforce is seeking help in areas such as emergency savings, paying down debt, and overall financial wellness, compared to 13% in 2023.

"The modern employee wants help with their broader financial goals," said Lorna Sabbia, Head of Workplace Benefits at Bank of America. "Employers should consider additional resources to support their workforce in ways that bolster their long-term goals while also helping them tackle short-term challenges."

Other areas where employees say they need financial wellness resources include retirement education and planning (36%), learning how to generate income in retirement (33%), and developing good financial skills and habits (33%).

Based on nationwide surveys of nearly 1,000 employees and 800 employers, the 15th annual Workplace Benefits Report explores employee financial well-being and retirement preparedness, the state of workplace benefits, and more.

Findings show that financial wellness benefits continue to matter to employees and employers, with more than 8 in 10 employers saying that financial wellness resources help drive job satisfaction, productivity, the ability to attract top talent, and be recommended as a great place to work. However, roughly half of larger employers (54%) offer financial wellness programs – and just a third (32%) of smaller companies.

The survey also found that workplace benefits are increasingly a factor in retaining talent, with nearly a quarter (24%) of employees today saying they recently left or have considered leaving their company because their workplace benefits are lacking, up from 15% in 2023.

Additional findings from the report include:

- Emergency Savings – Growing savings for unexpected expenses is employees' second-most important financial goal — trailing only saving for retirement. Feeling overwhelmed by how to prioritize all their financial needs at once, half of employees (53%) have not hit their emergency savings goal (62% of women compared to 44% of men), often citing the fact that they're living paycheck-to-paycheck among the primary reasons.

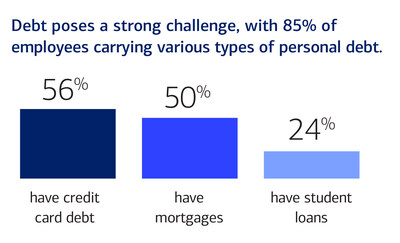

- Personal Debt – Nearly half of employees (45%) say they lack emergency savings due to a focus on repaying debt. This isn't surprising considering 85% of employees carry some form of personal debt, with 58% carrying credit card debt, specifically. Many employees say that it causes them stress and a loss of focus and productivity at work. Despite this, fewer than 1 in 3 companies offer credit counseling or debt assistance aside from student loans – yet more are planning to do so in the future.

- Retirement Readiness – While 2 in 3 employees (67%) feel confident that they're on track for the retirement lifestyle they envision for themselves, confidence varies by gender and life stage. 59% of women feel on track toward their retirement goals compared to 72% of men. Half of employees (49%) wish they started saving for retirement at a younger age.

- Equity Awards – 60% of employers say an equity award has been a differentiating factor when attracting and retaining talent. Nearly half of employees (48%) say they want their employer to add stock awards in the next few years, and nearly 1 in 3 employers (30%) plan to do so. Among employers who offer equity awards today, 66% say the number of employees receiving them has increased over the last three years, and 83% are considering further expanding their offerings.

"Some companies are evolving their financial benefits to keep up with the needs of their employees, while others remain focused on traditional benefits alone – such as retirement plans and health insurance," said Kai Walker, Head of Retirement Research and Insights at Bank of America. "Financial wellness programs, equity awards, debt assistance, caregiver support can all help attract and retain top talent."

Workplace Benefits Report Methodology

Escalent surveyed a national sample of 962 employees who are working full-time and participate in 401(k) plans, and 800 employers who offer both a 401(k) plan and have sole or shared responsibility for decisions made in the plan. The survey was conducted between December 2, 2024, and January 13, 2025. After the original research was complete, we complemented our annual study with an employee-focused supplemental survey conducted between April 10 and May 1, 2025. This survey consisted of 508 employees working full-time and participating in 401(k) plans. The mid-year touchpoint allowed us to better measure the direct impact of current market conditions on employee feelings of financial wellness. To qualify for the survey, employees had to be current participants of a 401(k) plan and employers had to offer a 401(k) plan option. Neither was required to work with Bank of America. Bank of America was not identified as the sponsor of the study.

Bank of America Institute

Bank of America Institute is dedicated to uncovering powerful insights that move business and society forward. Established in 2022, the Institute is a think tank that draws on data and analyses from across the bank and the world to provide timely and original perspectives on the economy, sustainability, and global transformation. The Institute leverages the depth and breadth of the bank's proprietary data, from approximately 68 million consumer and small business clients, 56 million verified digital users, $4.2 trillion in total payments in 2022 and $1.4 trillion in consumer and wealth management deposits. From this robust data set, the Institute provides a unique perspective on the health of the economy. It also elevates thought leadership from throughout the bank that addresses long-term trends and shares these findings with the general public.

Bank of America

Bank of America is one of the world's leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 69 million consumer and small business clients with approximately 3,700 retail financial centers, approximately 15,000 ATMs (automated teller machines) and award-winning digital banking with approximately 59 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 4 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and more than 35 countries. Bank of America Corporation stock is listed on the New York Stock Exchange (NYSE:BAC).

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom and register for news email alerts.

Bank of America is a marketing name for the Retirement Services business of Bank of America Corporation ("BofA Corp."). Banking activities may be performed by wholly owned banking affiliates of BofA Corp., including Bank of America, N.A., Member FDIC. Brokerage and Investment advisory services are provided by wholly owned non-bank affiliates of BofA Corp., including MLPF&S, a dually registered broker-dealer and investment adviser and Member SIPC.

Investment products

Are Not FDIC Insured Are Not Bank Guaranteed May Lose Value

© 2025 Bank of America Corporation. All rights reserved. MAP #8325851

Reporters may contact:

Don Vecchiarello, Bank of America

Phone: 1.980.387.4899

don.vecchiarello@bofa.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/bofa-report-percentage-of-workers-seeking-near-term-financial-guidance-from-employers-doubles-302545080.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/bofa-report-percentage-of-workers-seeking-near-term-financial-guidance-from-employers-doubles-302545080.html

SOURCE Bank of America Corporation