ST. HELIER, Jersey--(BUSINESS WIRE)--MAC Copper Limited (NYSE: MTAL; ASX: MAC)

MAC Copper Limited ARBN 671 963 198 (NYSE: MTAL; ASX: MAC), a private limited company incorporated under the laws of Jersey, Channel Islands (“MAC” or the “Company”) is pleased to release its December 2024 quarterly activities report (“Q4 2024” or “December quarter”).

HIGHLIGHTS

Record quarterly production of 11,320 tonnes at a 4.1% Cu grade

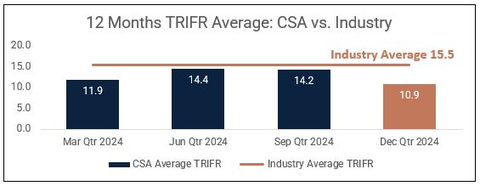

- Material improvement in TRIFR to 10.9 in Q4 2024 from a TRIFR of 14.2 recorded in Q3 2024

- Strongest quarterly production under MAC’s ownership beating the previous record set in Q2 2024

- 11,320 tonnes of copper produced for Q4 2024 (an 11% increase QoQ) at a grade of 4.1% Cu

- C1 of US$1.66/lb1 for Q4 2024 decreased by 12% (US$1.90/lb in Q3 2024), driven by increased production, continued improved cost management and operational efficiencies

- 41,128 tonnes of copper produced in 2024 (above the mid-point of 2024 production guidance) and an increase of 14% compared to 20232 with an average grade of 3.9% and a C1 of US$1.92/lb for the year

- 2025 C1 forecast to be positively impacted by3:

- a circa 70% reduction in TC/RC benchmarks (~US$0.16/lb impact) and

- operational costs benefits due to the lower A$:US$ exchange rate (+/-1 US$ cent = US$0.03/lb)

Targeting copper production of >50ktpa by 2026

- Growing copper production by ~23% by 20264 with key projects delivering the further step change

- Ventilation project – work well underway, advancing with completion targeted by Q3 2026

- QTS South Upper – development commenced in Q4 2024, ore mining expected to commence from Q4 2025

Generating material operational free cash flow

- Operational free cash flow for Q4 2024 of ~US$30M (~A$48M) including sustaining capex

- Sustaining capital expenditure of ~US$12M for Q4 2024 and ~US$50M for 2024

Increased liquidity and balance sheet strength

- Raised US$103M (A$150M5) (before costs) at A$18.00 per CDI as announced on 9 October 2024

- Cash and cash equivalents of ~US$172M (~A$276M) after repayment of ~US$8.3M in senior debt principal

- Liquidity of US$213M (~A$340M) includes ~US$6.5M of outstanding QP receipts, ~US$5.6M of unsold concentrate and the Polymetals (“POL”) investment as at 31 December 2024

- POL announced it secured financing to fund its mine restart by mid-2025 – the value of MAC’s investment in POL has increased to A$6.4M, up more than 125% since its initial investment.

- Reached agreement with Sprott to repay Mezzanine debt early at MAC’s option from 1 January 2025

ESG UPDATE

Safety

Achieved a Total Recordable Injury Frequency Rate (TRIFR) of 10.9 in Q4 2024 which is a material improvement from an average TRIFR of 14.2 in Q3 2024. This was a positive end to 2024 with no recordable injuries recorded for the quarter.

Total incidents recorded have also reduced significantly during the quarter with increased awareness from extensive training and coaching as well as increased leadership field safety interactions which is having a beneficial effect on safety.

Figure 1 - CSA Copper Mine Recordable Injuries by Quarter6

Sustainability Report

MAC recognizes the importance of our environmental, social and governance responsibilities and that sustainability strategies more broadly is integral to the way we operate and essential to the accomplishment of our goals.

As a result, in 2024, MAC completed a materiality assessment and stakeholder analysis to identify the key environmental, social and governance issues material to the business and important to our stakeholders.

To this end, we will be publishing our inaugural annual sustainability report at the same time as our annual report in Q1 2025 which will provide an overview of our material ESG topics, a summary of current performance and an outline of future activities and initiatives to improve our reporting and disclosures over time. The contents of the sustainability report are not intended to be incorporated by reference into our annual report or in any other report or document we file or furnish with the Securities and Exchange Commission, and any reference to the sustainability report is intended to be an inactive textual reference only.

Regulatory

Progress continues toward submission of the CSA Annual Rehabilitation Report due in April 2025. There have been no reportable environmental incidents during the December 2024 quarter and no reportable environmental incidents for 2024.

Construction activities on the Stage 10 embankment raise have been ongoing in the December 2024 quarter. Works on foundation preparation and development of the key trench within the West Mound have begun. West Mound works are planned for completion in Q1 2025 prior to progressing to the East Mound construction.

PRODUCTION AND COST SUMMARY

Table 1 – Production and cost summary (unaudited)

|

Units |

Q1 2024 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

QoQ |

Full year |

Copper Production |

Tonnes |

8,786 |

10,864 |

10,159 |

11,320 |

11.4% |

41,128 |

Unless stated otherwise all references to dollar or $ are in USD.

Q4 2024 demonstrated consistent mining processes that delivered above 10kt of copper production for three consecutive quarters. Production further benefited from a grade of 4.1% for Q4 2024 with copper grade for the month of December 2024 recorded at 4.52%. The grade achieved continues to demonstrate the high-quality ore body present at CSA mine.

Figure 2 - CSA Copper Mine Quarterly Copper Production (tonnes)

The average received copper price after hedge settlements was slightly lower compared with the prior quarter with Q4 2024 at US$4.02/lb, compared to US$4.04/lb for Q3 2024, with the average spot copper price over the December quarter at ~US$4.16/lb.

In addition, the average A$:US$ exchange rate of ~US$65 cents for Q4 2024 declined by ~2.5% compared to Q3 2024 to ~US$67 cents which also marginally improved our US$ reported C1 cost, with the A$:US$ exchange rate further weakening to ~US$62 cents by the end of 2024.

C1 cash costs decreased by ~12% quarter on quarter from US$1.90/lb in the September quarter to US$1.66/lb for Q4 2024. The higher production tonnes, as detailed above, resulted in a positive impact to C1 costs of approximately US$0.19/lb, whilst the overall cost variance had a positive impact of approximately US$0.05/lb.

Figure 3 - CSA Copper Mine C1 Cash Costs14 - US$/lb produced