1. Global TWS shipments reached 92.6 million units in 3Q25. 2. OWS shipments surged 69% YoY, hitting over 10 million units. 3. Apple leads TWS market despite a 4% decline in shipments. 4. Emerging markets show aggressive growth through pricing strategies. 5. OWS will account for 10% of the TWS market by 2026.

FAQ

Why Neutral?

The modest growth in shipments suggests no immediate significant impact. Historically, similar trends in tech markets have stabilized stock prices.

How important is it?

The article relates closely to TTGT's market presence through Omdia. Insights can guide strategic positioning in evolving consumer tech.

Why Long Term?

OWS category growth will evolve consumer preferences over time, impacting the broader audio device market.

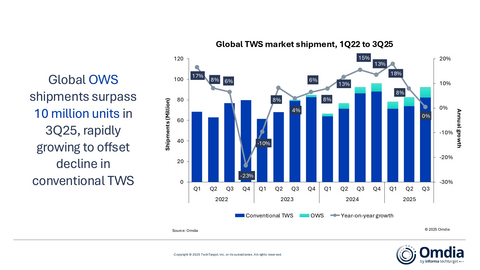

Global TWS shipments reached 92.6 million units in 3Q25, up just 0.33% year-over-year (YoY), according to Omdia's latest research. Although overall growth was modest, shipments of Open Wireless Stereo (OWS), a type of non-in-ear TWS device, surpassed 10 million units, marking a 69% increase YoY. This growth offset a 4% decline in conventional TWS shipments, which totaled 82 million units.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251209628026/en/

Global TWS market shipment, 1Q22 to 3Q25

"We're witnessing the democratization of ANC technology at sub-US$25 price points, while premium brands are pivoting from volume wars to value creation," said Omdia Analyst Jack Leathem. "Vendors are focusing on experiences that deepen loyalty rather than on share expansion alone. The market is now diverging along two distinct paths: premium differentiation with top-notch ANC and sound quality supported by AI and health feature integration, and accessible innovation in emerging markets."

Apple remained the global revenue leader despite a 4% shipment decline, capturing around half of all TWS market value through ecosystem strength and premium positioning. Its latest generation AirPods Pro 3 strengthens health tracking through integrated heart-rate sensing, demonstrating how ecosystem stickiness outweighs unit volume in the premium tier. Meanwhile, Xiaomi held second place, achieving triple-digit growth across Latin America and other emerging markets through accelerated feature rollout in the sub-US$50 segment.

"OWS crossing the 10-million-unit quarterly shipment threshold represents more than a milestone - it validates OWS as a legitimate category that is reshaping how consumers think about hearable devices," noted Omdia Research Manager Cynthia Chen. "However, inherent sound quality limitations keep most OWS products concentrated in the US$50-150 mid-range, making it difficult to compete directly with high-end in-ear models."

Leading vendors are actively pushing ASPs above US$100 to avoid price-led competition, resulting in faster growth than OWS priced under US$100 in 3Q25. Huawei and Shokz lead the advanced OWS segment with contrasting strategies: Shokz focuses on sports and safe listening, while Huawei drives AI-enabled, intelligent experiences through premium hardware integration.

"Open form factor designs that do not enter the ear encounter sound quality limitations compared to conventional TWS, making long-term user retention dependent on delivering ongoing functional benefits beyond initial use," Chen explained. "As a dynamic category, OWS is positioned for rapid growth, particularly as the industry explores new avenues for enhanced features through strong integration with key user scenarios, such as during workouts or in office settings. Emphasizing long-term comfort and innovative AI-enabled features will be essential for sustaining momentum and meeting the evolving demands of consumers."

The market's structural transformation extends beyond form factors to encompass regional dynamics and technological capabilities. Emerging markets continue to drive volume growth through aggressive pricing and feature democratization, while developed markets increasingly prioritize premium experiences and ecosystem integration. This bifurcation creates opportunities for vendors to pursue parallel strategies across different geographic segments and price tiers.

Omdia forecasts that OWS shipments will reach 40 million units in 2026, representing 10% of the total TWS market. This projection reinforces open-ear audio's strategic importance in reshaping the broader wearable audio landscape as vendors balance traditional performance metrics with emerging user experience priorities. The next phase of market differentiation will center on AI-driven personalization, seamless device ecosystem integration, and sustained comfort-led design innovations that address the evolving demands of an increasingly sophisticated consumer base.

Global TWS shipment and annual growth

|

|||||

Vendor |

3Q25

|

3Q25

|

3Q24

|

3Q24

|

Annual

|

Apple |

18.9 |

20% |

19.8 |

21% |

-4% |

Xiaomi |

8.6 |

9% |

6.9 |

7% |

+24% |

Samsung |

7.0 |

8% |

8.3 |

9% |

-16% |

boat |

6.7 |

7% |

7.6 |

8% |

-11% |

Huawei |

5.0 |

5% |

3.7 |

4% |

+35% |

Others |

46.4 |

50% |

46.0 |

50% |

+1% |

Total |

92.6 |

100% |

92.3 |

100% |

+0.3% |

|

|

|

|||

Note: Huawei excludes HONOR since 1Q21. OPPO includes OnePlus. vivo includes iQOO. Percentages may not add up to 100% due to rounding. Source: Omdia Smart Personal Audio Service (sell-in shipments), October 2025 |

|||||

Global OWS shipment and annual growth

|

|||||

Vendor |

3Q25

|

3Q25

|

3Q24

|

3Q24

|

Annual

|

Huawei |

0.9 |

8% |

0.4 |

7% |

+118% |

Edifier |

0.8 |

7% |

0.2 |

3% |

+338% |

Sanag |

0.7 |

7% |

0.6 |

9% |

+31% |

Baseus |

0.7 |

7% |

0.1 |

2% |

+560% |

Anker |

0.7 |

7% |

0.4 |

6% |

+95% |

Others |

6.5 |

63% |

4.5 |

74% |

+44% |

Total |

10.3 |

100% |

6.1 |

100% |

+69% |

|

|

|

|||

Note: Huawei excludes HONOR since 1Q21. OPPO includes OnePlus. vivo includes iQOO. Percentages may not add up to 100% due to rounding. Source: Omdia Smart Personal Audio Service (sell-in shipments), October 2025 |

|||||

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (NASDAQ:TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients' strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251209628026/en/

Fasiha Khan – fasiha.khan@omdia.com